![]()

Journalist

Share this article

- BNB’s volume has dropped by around 15% in the last 24 hours.

- Its price has trended without any significant moves in the last few days.

XRP’s dramatic ascent has dethroned Binance Coin [BNB] from its top-five ranking by market capitalization. The gap is widening, with XRP’s market cap exceeding $109 billion compared to BNB’s $94 billion.

Over the past week, XRP has surged by 37%, while BNB’s growth has been muted at less than 1%. As investors turn their attention to XRP’s momentum, BNB’s price action and metrics offer insights into what could lie ahead for Binance’s native token.

XRP’s momentum dominates headlines

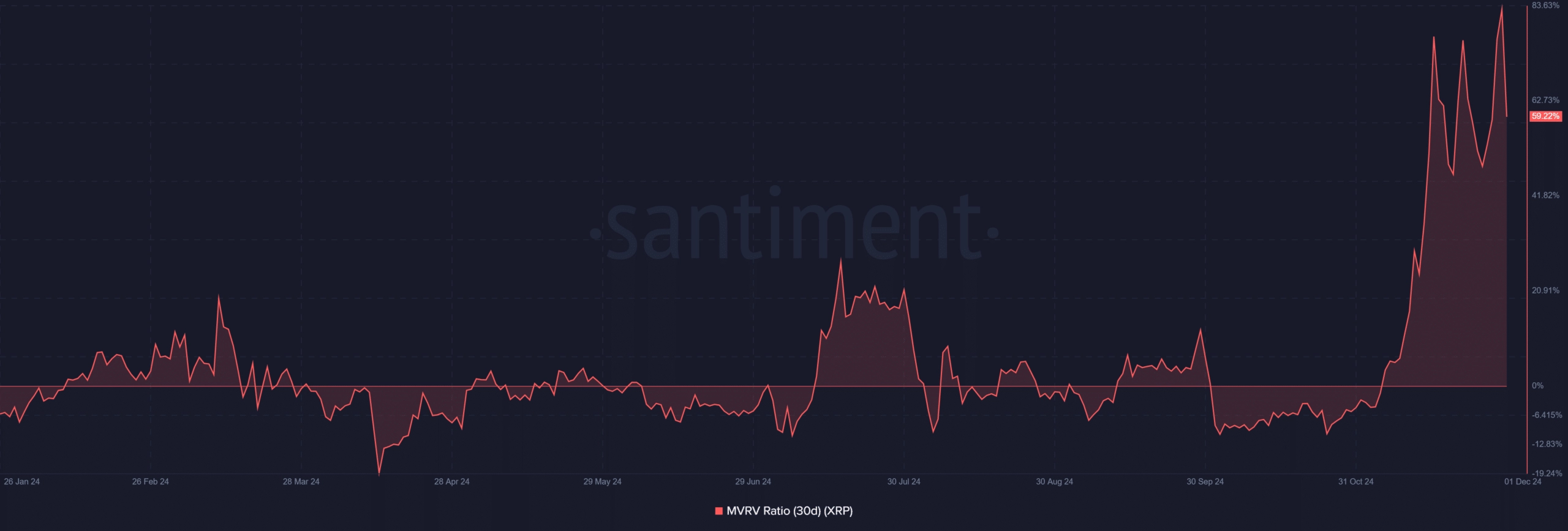

XRP’s price surge, fueled by renewed investor interest and strong fundamentals, has redefined the market hierarchy. The 30-day MVRV (Market Value to Realized Value) ratio for XRP highlights its rally, hovering above 59%, signaling an overvalued territory.

Source: Santiment

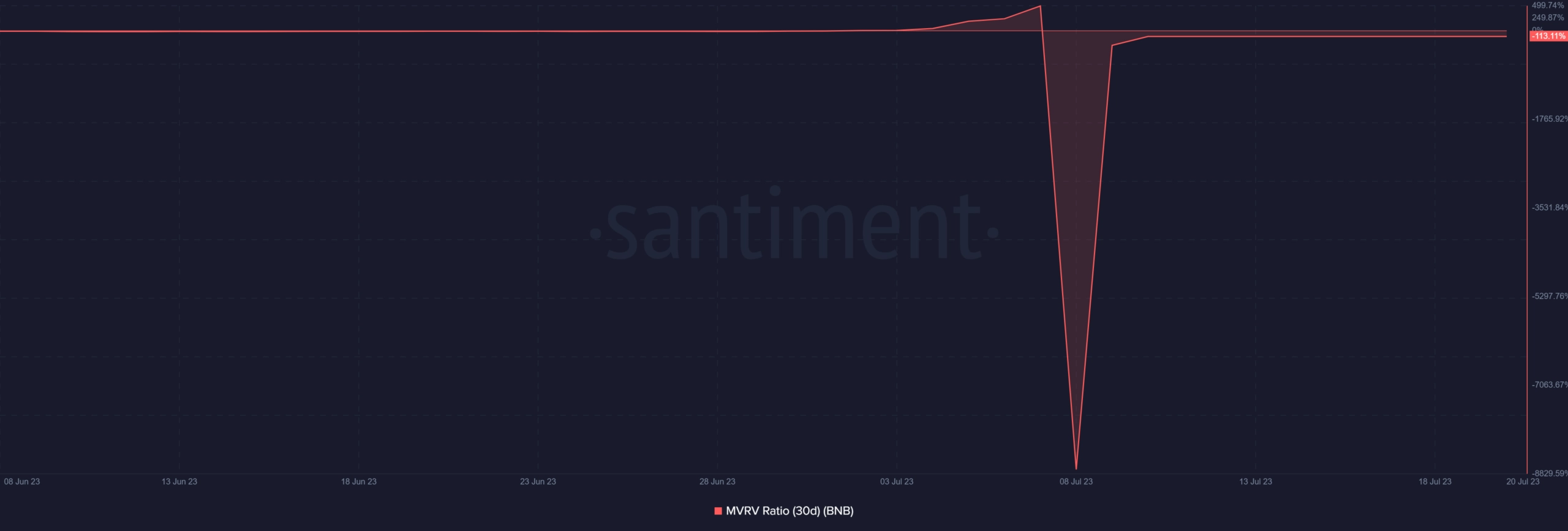

Meanwhile, Binance’s BNB MVRV showed a less enthusiastic trend, dropping well into the undervalued territory. As of this writing, the MVRV is around -113%. Aside from showing how undervalued BNB is, this trend shows how much loss holders were seeing.

Source: Santiment

Historically, a low MVRV for BNB has preceded upward price corrections. Still, the absence of strong volume support could keep the token in its consolidation range.

Binance current trend: Stability or stagnation?

The daily chart for Binance (BNB) showcases a tight consolidation phase, with its price hovering around $658.3. The MACD indicator highlights weak bullish momentum, while the Chaikin Money Flow (CMF) suggests limited inflows into the asset.

Accumulation/Distribution (A/D) levels have remained steady, underscoring a lack of significant buying or selling pressure.

Source: TradingView

The 50-day moving average sits comfortably above the 200-day average, maintaining a bullish crossover. However, the lack of volume surge raises questions about the sustainability of the current trend.

Binance still in contention

For BNB to regain momentum, a breakout above $670 with increased trading volume is essential. Conversely, failure to sustain current levels could cause the BNB to test the $640 support zone.

XRP’s dominance in the short term might overshadow BNB, but Binance Coin’s role within the Binance ecosystem ensures its long-term relevance.

Is your portfolio green? Check out the Binance Profit Calculator

While XRP’s rise has reshuffled the rankings, BNB’s metrics indicate a period of consolidation rather than outright decline.

XRP may have the spotlight for now, but BNB’s stability suggests it is far from out of the game.