Wynn Resorts' emphasis on premium customers helped the casino sidestep a slow period for Vegas tourism in the second quarter.

While the lull in Las Vegas tourism has been well-publicised this summer, Wynn Resorts largely dodged the downturn in second-quarter earnings.

Travel to Las Vegas plunged 11% in June, according to the Las Vegas Convention and Visitors Authority, providing a harbinger that customers are reconsidering a vacation to Sin City in tough economic times. But Wynn, which caters to higher-end customers, emerged from the carnage relatively unscathed.

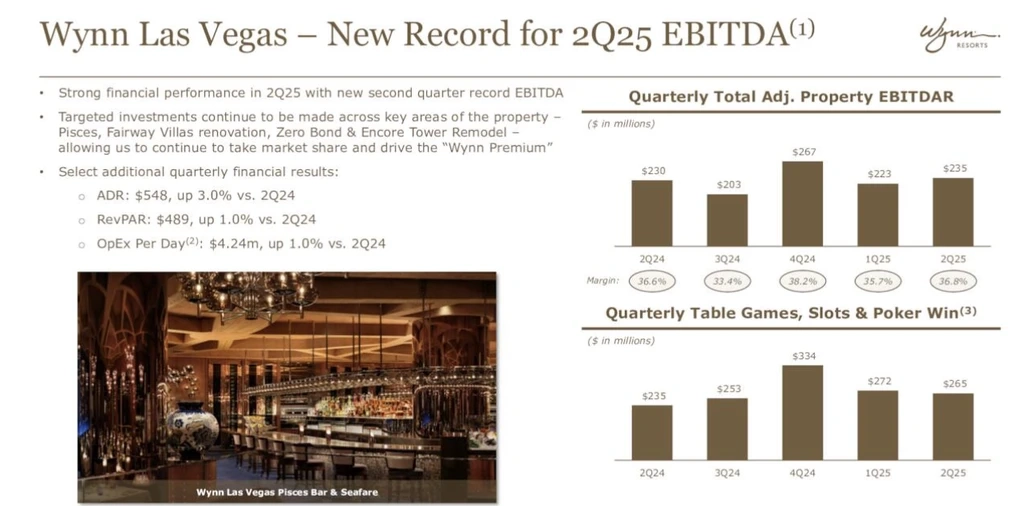

During Wynns second quarter of 2025, the average daily rate for its Las Vegas hotels came in at $548, up 3% year-over-year. The metric is viewed as a key indicator for earned revenue based on occupancy levels at Strip properties. In addition, Wynn Resorts CEO Craig Billings appears pleased with metrics on table game and slot machines, as well as receipts at luxury restaurants at Wynns Vegas properties.

We remain positive about the business in Las Vegas, Billings said during Thursdays Q2 earnings call. We sit in a unique position. Were not the best barometer of Las Vegas at large.

Another factor stoking Billings optimism for Wynns performance in Vegas stems from booking levels in July. Last month, Wynn saw forward bookings advance as the month progressed, Billings noted. While Wynn indicated that its convention and group business looks strong heading into the fourth quarter, the company is pleased with bookings for this falls Formula 1 Las Vegas Grand Prix, taking place for the third year.

Despite the strong quarter, Wynn saw profits fall sharply to $66.2 million or $0.64 per share, in comparison with $111.9 million or $0.91 a share in the same quarter in 2024. Wynn also posted adjusted earnings per share of $1.09, failing to meet analysts per-share expectations of $1.20.

Wynn experienced softness in Macau over the quarter, generating revenue of $343.8 million. Billings pointed to a down period from its VIP segment, which delivered lower-than-expected hold. In total, the VIP hold provided a negative impact of $13 million for the quarter.

Wynn traded at around $105 a share on Friday morning, down about 2% on the session. Wynn shares have jumped about 60% since US President Donald Trumps tariff announcement in April. The company is also up approximately 37% over the last 12 months.

The company held Thursdays call as reports surfaced that former NBA player Marcus Morris had charges dropped after he repaid a series of debts to two Las Vegas casinos. Morris, a 14-year NBA veteran, repaid debts totalling $250,000 to Wynn Las Vegas and the MGM Grand, CBS affiliate KLAS reported.

Over the second quarter, Wynn generated operating revenues in Las Vegas of $638.6 million, up nearly $10 million from $628.7 during the same quarter in 2024. Amid healthy demand on the casino side, Wynn saw increases in both drop and handle for the three-month period ended 30 June.

As a result, Wynn reported adjusted property EBITDA of $234.8 million for the quarter, a slight increase from $230.3 million in the year-ago quarter.

Wynn also provided an update on renovation plans for the Encore Tower in Las Vegas. Construction for the remodelling of the tower is set to begin next spring, CFO Julie Mireille Cameron-Doe said. The project, which will take about a year to complete, is estimated to cost about $330 million.

However, the strong period for Wynns Las Vegas segment came as profits overall fell for the company on the quarter. It is one reason why Wynn traded lower on Friday in response to the quarterly results.

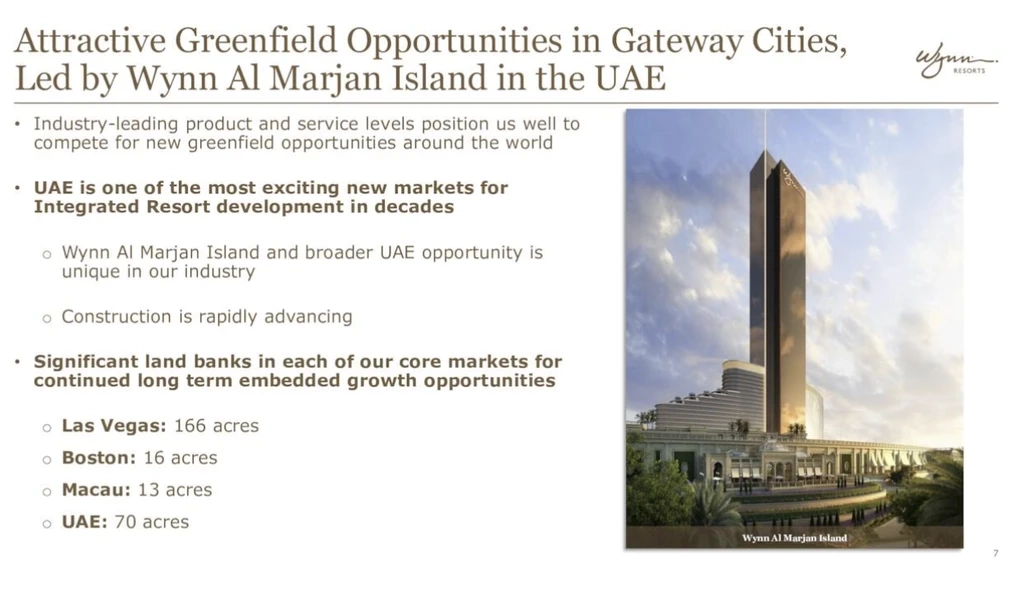

Wynn Resorts is moving closer to the 2027 grand opening of Wynn Al Marjan Island, the first licensed casino in the United Arab Emirates. Billings indicated that construction for the project continues to progress rapidly, with developments on the 61st floor of a 1,000-foot tower ongoing this month.

During the quarter, Wynn continued drawing on the Al Marjan construction loan with $395 million to date, Cameron-Doe noted.

As of this week, Wynn remains the only casino to be licensed by the UAEs General Commercial Gaming Regulatory Authority.

Various estimates have placed the total addressable market in Dubai in the range of $5 billion to $8 billion a year. Wynn Al Marjan Island will be the companys first new project under its current management team. Consequently, the Dubai project is the companys top priority at the moment, Billings explained.

Were building and opening a small city, Billings said. We need to be in a position to knock the cover off the ball.