- According to WoodMac, the power sector currently faces a capacity gap of 1,400 GW for battery installations to achieve grid stability by 2034.

- Falling costs improve the bullish thesis for battery storage, with WoodMac revealing that battery energy storage prices declined by an average of 10% to 40% across global markets over the past year alone.

- The United States battery production sector is facing an uncertain future after President Donald Trumps One Big Beautiful Bill Act rolled back many clean energy credits.

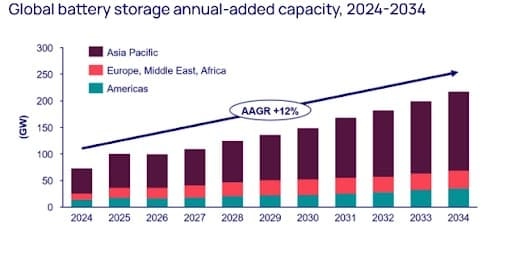

A couple of years ago, Bloomberg New Energy Finance (BNEF) made a bold prediction that wind and solar energy will make up half of the planets electricity generation by the middle of the century, thanks to the rapid transition to low-carbon energy. However, the intermittent nature of these sources makes large-scale storage critical as renewable energy becomes the dominant power source, with the experts predicting that battery storage is set to boom in the coming years. And now experts at Wood Mackenzie have put a number on it, saying the world will require a staggering $1.2 trillion in battery storage investments to support over 5,900 GW (Gigawatt) in new wind and solar installations over the next decade.

Grid-forming battery energy storage systems represent a critical breakthrough for renewable energy integration , said Robert Liew, research director at Wood Mackenzie. As global power demand is projected to surge 55% by 2034, with variable renewable energy comprising over 80% of new capacity additions, GFM BESS provides the technological bridge between renewable abundance and grid stability requirements .

According to WoodMac, the power sector currently faces a capacity gap of 1,400 GW for battery installations to achieve grid stability by 2034. This represents a huge market opportunity with more countries focusing on battery investments as renewable generation continues growing. Falling costs improves the bullish thesis for battery storage, with WoodMac revealing that battery energy storage prices declined by an average of 10% to 40% across global markets over the past year alone.

Source: Wood MacKenzie

U.S. Battery Production Set To Decline

Previously, we reported that the United States has witnessed a 15-fold increase in utility-scale battery storage capacity over the past five years to nearly 30,000 megawatts (30 GW), largely driven largely by falling battery costs. A total of 19 states have installed at least 100 MW in utility-scale battery storage over the period.

Unfortunately, the United States battery production sector is facing an uncertain future after President Donald Trumps One Big Beautiful Bill Act rolled back many clean energy credits.

The OBBBA will significantly alter the landscape of battery manufacturing in the United States by phasing out many tax credits and funding for clean energy and EV production, while simultaneously promoting fossil fuels. This shift is expected to reduce investment in clean energy technologies, including batteries, and potentially slow down the growth of the domestic EV market. A recent analysis by the International Council on Clean Transportation estimates that OBBBA cuts to climate policies could force U.S. battery production to decline by ~75%, with battery production now expected to clock in at 250 GWh by 2030, down from earlier projections of 1,050 gigawatt-hours while EV sales are expected to come in 40% lower than earlier projections. Following the passing of the Inflation Reduction Act (IRA) in 2022, companies announced nearly 130 U.S. facilities for battery manufacturing, with less than half yet to begin construction. Interestingly, red and purple states , including Texas, Michigan, Tennessee, Georgia, Kentucky and Nevada are likely to be the most adversely impacted by the OBBBA cuts.

However, the bear case for the U.S. battery manufacturing sector is not cut and dried. OBBBA modifies the Section 45X credit, which supports the production of solar and battery components in the US. On one hand, it phases out credits for critical minerals used in batteries starting in 2031 (75% in 2031, 50% in 2032, 25% in 2033, and 0% thereafter). However, on the other hand, credits for battery modules and other components like voltage-sense harnesses remain, encouraging domestic integration.

Interestingly, China has taken a different trajectory as far as grid stabilization is concerned. Over the past year, China accounted for 24.6 GW in new global hydropower capacity commissioned, good for nearly 60% of the global total. Of Chinas 14.4 GW additions, 7.75 GW was pumped storage hydropower (PSH), regarded as a cost-effective, long-duration energy storage method thats cheaper and with much greater storage potential than lithium-iron batteries. China is quickly ramping up hydropower construction as part of its goal to attain carbon neutrality by 2060. According to Chinas National Energy Administration , China had 436 GW in installed hydropower capacity as of the end of 2023, more than a third of the countrys 1,200 GW in combined wind and solar capacity. Chinas revised Energy Law , which took effect in January 2025, encourages development of PSH projects, with a recent IHA report predicting that With more than 200 GW of PSH projects under construction or approved, China is on track to exceed its 2030 target of 120 GW, potentially reaching 130 GW by the end of the decade.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com