- TRUMPs Open Interest surged after Eric Trumps tweet revealed WLFIs stake acquisition

- Is this another manipulative play, or will it spark real, lasting attention?

The Official Trump [TRUMP] memecoin is back in the spotlight. Not for another unlock event or whale shuffle, but for a strategic move thats split the market in two.

On one side, youve got the bulls calling it the ignition spark TRUMP needed.

On the other side? The skeptics.

Theyre calling it textbook memecoin theater, echoing the rinse-and-repeat cycles weve seen play out before.

Still, with sentiment turning, liquidity heating up, and the potential for a full-blown trend reversal, TRUMP could be entering its own mini Renaissance phase One you might not want to sleep on.

WLFI taps into TRUMP memecoin mania

On X (formerly Twitter), Eric Trump dropped a bombshell World Liberty Financial (WLFI) is accumulating a significant position in TRUMP for their long-term treasury reserve.

He tweeted,

I am proud to announce that the TRUMP Meme Coin has aligned with World Liberty Financial. Although their meme wallet isnt moving forward, they remain focused on building the most exciting MEME on earth $Trump.

And, the timing couldnt have been better. TRUMP has already capitulated all its May gains, retracing back to its late-April support band on the charts.

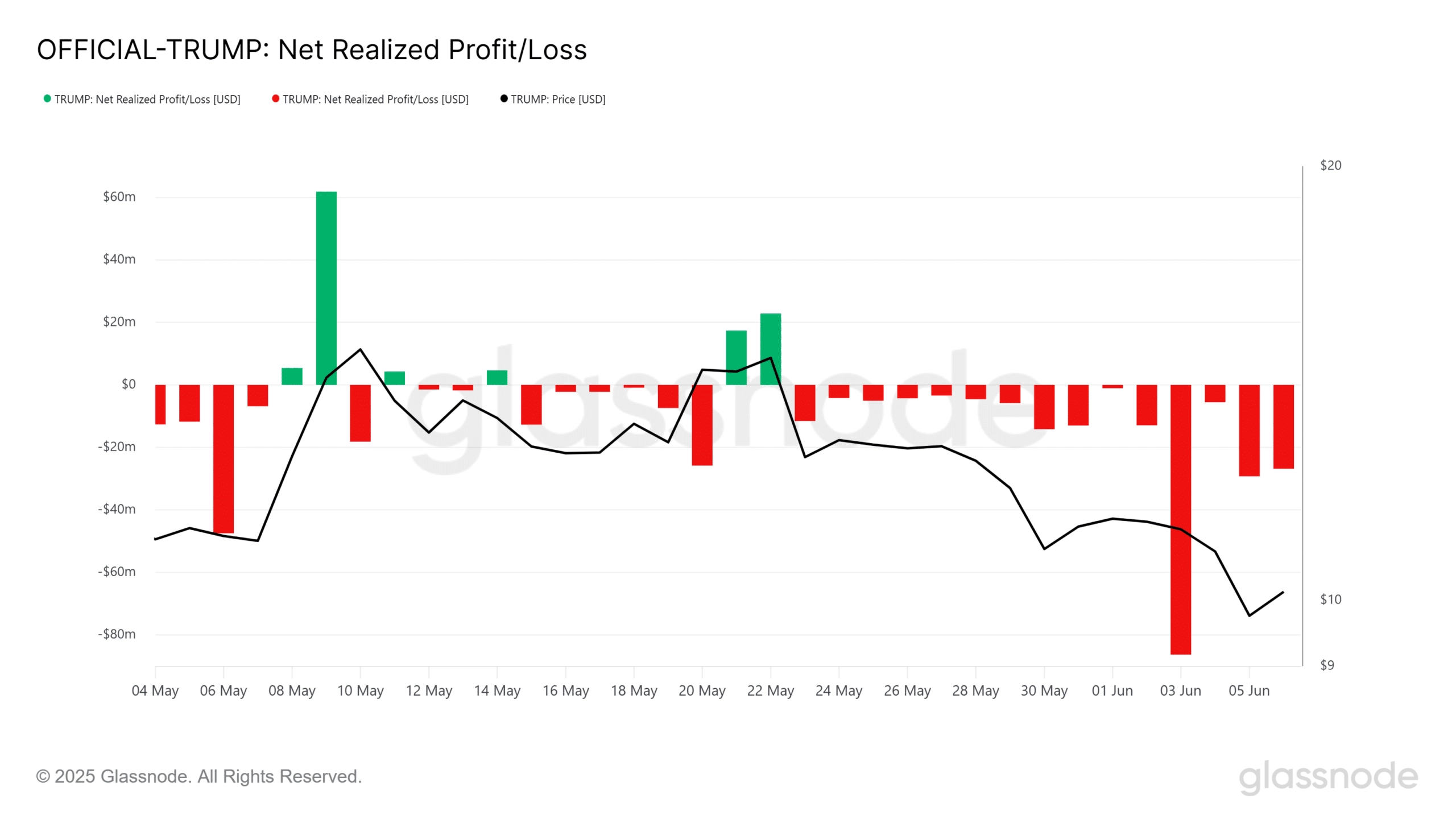

Meanwhile, at the time of writing, the negative Net Realized Profit/Loss (NRPL) signaled that HODLers are bag-holding, taking losses and selling below their cost basis. It is a clear indication of waning conviction in the token.

Source: Glassnode

So, when Eric Trump hints at a move like this, markets tend to react with heightened volatility and volume spikes.

On the derivatives front, TRUMPs Open Interest (OI) exploded by 10.61% to $449 million at press time. All while the price popped 6.73% off a $9.73 low just 48 hours ago.

However, lets not get too ahead of ourselves. This isnt the first time a headline-driven pop has outpaced actual protocol mechanics. Without backend follow-through, these spikes tend to be short-lived.

Flashback to early March The infamous strategic reserve tweet sparked Bitcoins longest daily candle since the election +9% in a day. Five sessions later? BTC retraced by 17.5%.

Which brings us to now Is this TRUMP pump just another X-fueled wick destined for reversion?

Cautionary voices in the crowd

A modest 6%+ price uptick, alongside a subtle surge in new address growth and rising derivatives activity, could be a sign of early-stage FOMO. However, its far from a decisive accumulation signal.

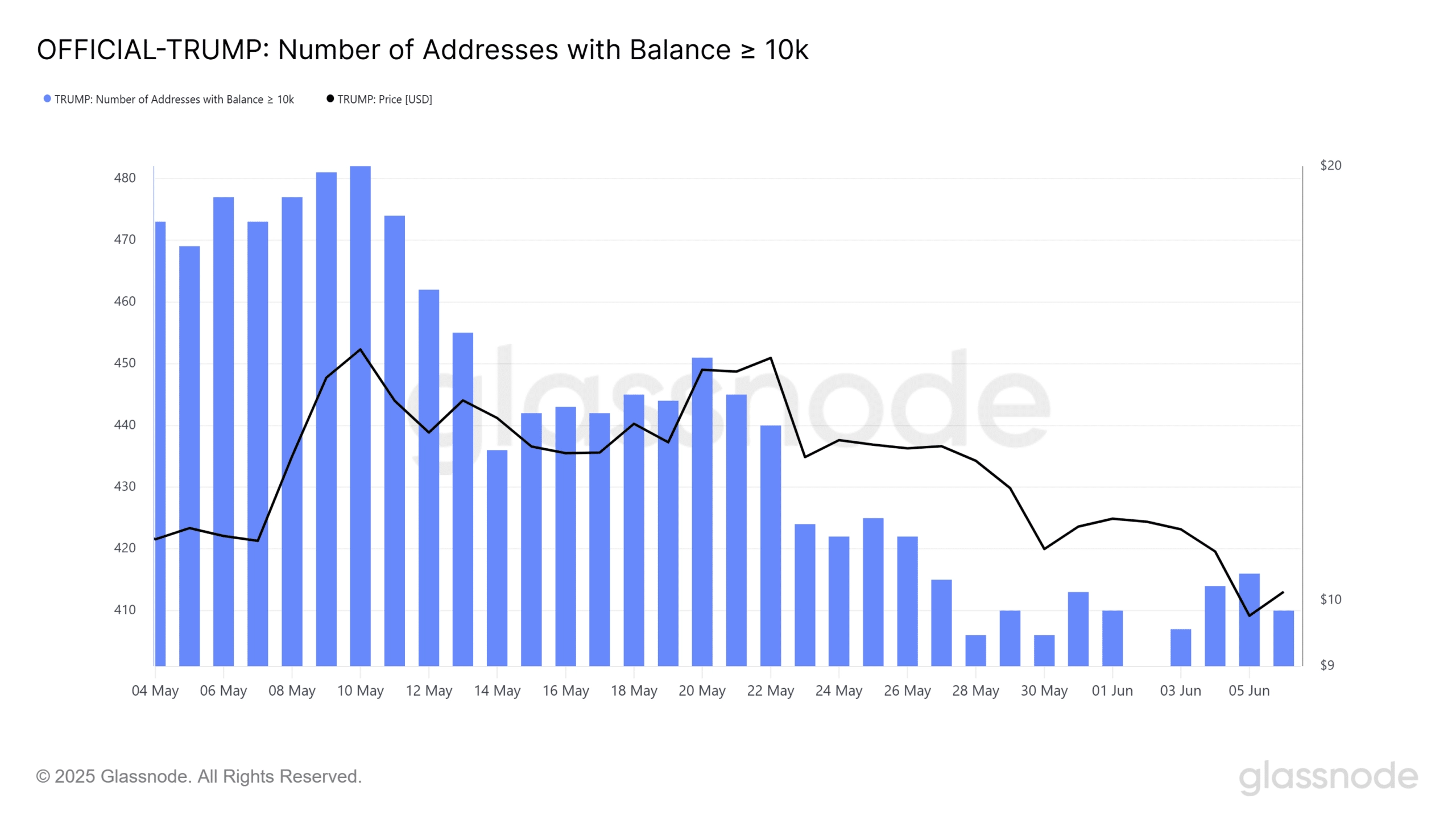

Especially since the dominant whale cohort (holders of 10k+ TRUMP tokens) remains sidelined, likely adopting a wait-and-see stance until WLFI converts rhetoric into on-chain execution.

Source: Glassnode

And, for good reason too. Recent data showed President Trumps crypto ventures have minted around $1 billion in just nine months, pumping his net worth up 22% to $5.6 billion.

Additionally, WLFIs advisor opening a short on TRUMP signalled underlying tension, fueling the ongoing insider manipulation narrative.

All in all, while WLFIs acquisition has sparked some structural demand and market interest in the memecoin, speculative and regulatory headwinds remain significant.

Until those risks are clearly mitigated, positioning this event as a definitive bullish catalyst could be premature and overly optimistic.