The New York Stock Exchange trading floor. Photo Credit: Tobias Deml

Rosenblatt Securities disclosed that updated target today, after Spotify posted a net loss and solid MAUs growth for Q2 2025. In keeping with long-running trends rapid user expansions in emerging markets and a plateau in their established counterparts regions besides North America and Europe now account for a clear majority of Spotify users.

Specifically, 57% of the companys nearly 700 million MAUs reside in either Latin America (21%) or Rest of World (36%). On the paid-listening front, the same regions make up a combined 37% of subs up from 35% in Q2 2024 with Rest of World kicking in only 14%.

Furthermore, the platform and competing DSPs charge significantly less in the relevant nations; even in Europe, Turkey-based users can currently subscribe to a single-listener Spotify Premium plan for the equivalent of $1.50 per month.

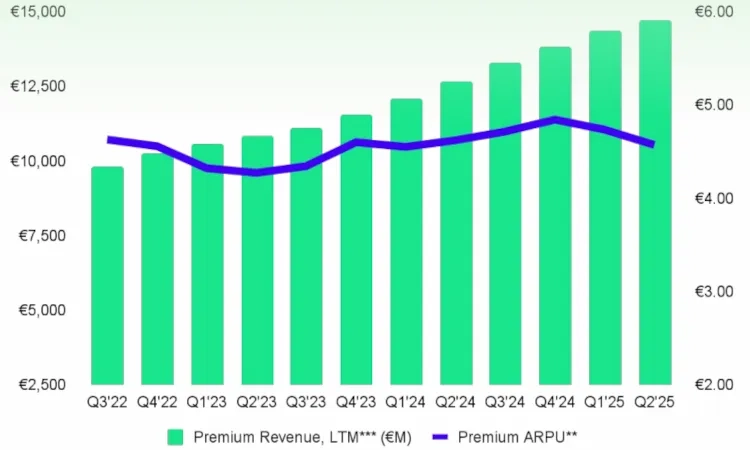

Following all these factors to their logical conclusion, Spotify pointed to a Premium ARPU decline of -1% Y/Y to �4.57, currently $5.24, for 2025s second quarter.

A breakdown of Spotify ARPU for Premium as well as total Premium revenue during the 12 months preceding each noted quarter. Photo Credit: Spotify

(The company also acknowledged monetization challenges across the entire ad-supported side; revenue declined 1% YoY in Q2, and Spotifys ads head, Lee Brown, has exited his post. But there are certainly market realities in play here. On the other hand, the decrease arrived despite an aggressive video buildout.)

Back to the initially mentioned SPOT assessment, Rosenblatt lowered its target from $703 to $679.

The entity also maintained a neutral rating, describing ARPU as a tad light and touching on the quarters heightened costs as well as the meaningfully light Q3 guidance. (Operating expenses swelled 8% YoY to $1.05 billion/�914 million.)

The adjusted target still represents a bit of a climb for SPOT, which, having topped $700 on Monday, dipped beneath $620 yesterday and was hovering around $645 at the time of writing.

ARPU rather unsurprisingly came up directly and in terms of adjacent revenue-growth prospects during Spotifys earnings call.

At the top level, higher-ups defended their freemium-funnel model, reiterated that the period delivered the second-most net MAU additions of any Q2 thus far, and emphasized bigger-picture growth.

And in the developed markets, of course, we see uplifts in ARPU, said CFO Christian Luiga. Meanwhile, in the emerging markets, with a strong intake, that will of course have more dilution to ARPU in the short term. But over the long term, it creates a lot of value for Spotify.

Regarding possible steps to enhance ARPU in the near term, company brass offered noncommittal remarks when discussing the long-awaited Deluxe/Supremium/Music Pro tier. Logic and evidence suggest that Spotifys bundling craze has resulted in compositional-licensing hurdles here.

Addressing potential price increases, chief business officer Alex Norstr�m indicated that Spotify will bump monthly charges when its appropriate for the business.

[A]s far as pricing goes, we will raise prices when its appropriate for the business, said Norstr�m. And I want to also remind you that we take a portfolio approach. So in a sense, you could say that we raise all the time. For instance, in the last quarter we raised in France, Belgium, the Netherlands, and Luxembourg. And I can report to you that on churn, we didnt see anything out of the ordinary for Spotify.