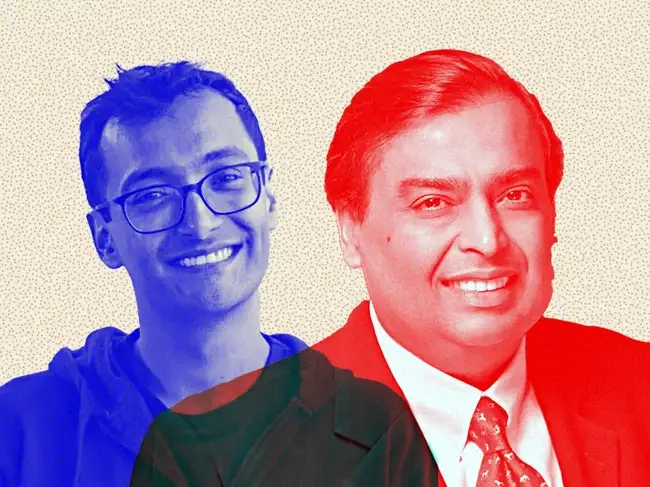

ETtech Reliance Industries has written off its investment in hyperlocal delivery platform Dunzo, according to its annual report for FY25. Reliance Retail had led a $240-million (around Rs 1,800 crore) funding round in Dunzo in January 2022, acquiring a 26% stake in the Bengaluru-based company.

ETtech Reliance Industries has written off its investment in hyperlocal delivery platform Dunzo, according to its annual report for FY25. Reliance Retail had led a $240-million (around Rs 1,800 crore) funding round in Dunzo in January 2022, acquiring a 26% stake in the Bengaluru-based company.

In its FY24 annual report, Reliance had valued this stake at Rs 1,645 crore. The conglomerate had invested in Dunzo to expand its presence in the fast-growing quick commerce space.

Despite raising over $450 million in total including $200 million from Reliance Retail, Dunzo struggled to stay afloat amid intensifying competition in the segment. Its aggressive push for growth, including the launch of Dunzo Daily, a 1520-minute grocery delivery service, led to a sharp rise in monthly expenses, which crossed Rs 100 crore at one point.

Costly marketing initiatives, such as a high-profile Indian Premier League (IPL) sponsorship, boosted visibility but also worsened the companys cash burn. While Dunzo gained business volume, it failed to shed its image as primarily a courier service, a perception that hampered its quick commerce ambitions.As funding dried up and cash reserves depleted, Dunzo was forced to extend its delivery timelines from 15 minutes to 60 minutes in a bid to lower costs through order batching. The situation was compounded by a broader slowdown in Indias startup funding environment through 2023.By 2024, the company had drastically scaled down operations in both quick commerce and courier services, undergoing multiple rounds of layoffs. In contrast, rivals such as Swiggys Instamart, Zomato-owned Blinkit, and Zepto continued to expand their footprint.The final blow came in early 2025 when Dunzos app and website went offline, shortly after cofounder and CEO Kabeer Biswas stepped down. He now heads Walmart-backed Flipkarts quick commerce vertical, Flipkart Minutes.

Between late 2023 and 2024, much of Dunzos leadership team exited as the company struggled to raise fresh capital. In SeptemberOctober 2023, five members of its board of directors resigned. Around the same time, cofounder Dalvir Suri, who headed Dunzo Merchant Services, also left the company.Following Suris exit, cofounders Mukund Jha and Ankur Agarwal departed the firm to pursue new ventures.Besides Reliance, Google was another major investor in Dunzo, holding a 20% stake.

Also Read: Dunzos demise: How the Reliance-backed hyperlocal delivery startup unravelled

Elevate your knowledge and leadership skills at a cost cheaper than your daily tea.

-

As RBI retains GDP forecast, 4 factors that will test the strength of Indian economy

As RBI retains GDP forecast, 4 factors that will test the strength of Indian economy -

Indias last cement IPO did not work. Can JSW Cement break that curse?

Indias last cement IPO did not work. Can JSW Cement break that curse? -

Is Shadowfax closing in on its closest rival?

Is Shadowfax closing in on its closest rival? -

Can Coforges ambition to lead the IT Industry become a reality?

Can Coforges ambition to lead the IT Industry become a reality? -

Berlin to Bharuch: The Borosil journey after the China hit in Europe

Berlin to Bharuch: The Borosil journey after the China hit in Europe -

Stock Radar: Syngene International showing signs of momentum after falling 26% from highs; what should investors do?

Stock Radar: Syngene International showing signs of momentum after falling 26% from highs; what should investors do? -

Two Trades for Today: A life insurance major for a 4.85% upmove, a mid-cap diesel engine maker for almost 7% rise

Two Trades for Today: A life insurance major for a 4.85% upmove, a mid-cap diesel engine maker for almost 7% rise -

Multibagger or IBC - Part 18: This auto ancillary started with wheels. It now also powers wind & war

Multibagger or IBC - Part 18: This auto ancillary started with wheels. It now also powers wind & war -

Auto stocks: Yes, headwinds in the short term, but will structural change become tailwinds and prove analysts wrong?

Auto stocks: Yes, headwinds in the short term, but will structural change become tailwinds and prove analysts wrong?