- Pudgy Penguins (PENGU) eyes a $0.11 breakout target amid strong ETF speculation.

- The derivatives market shows $7.67 million in longs vs. $3.18M in shorts, indicating a strong bullish bias.

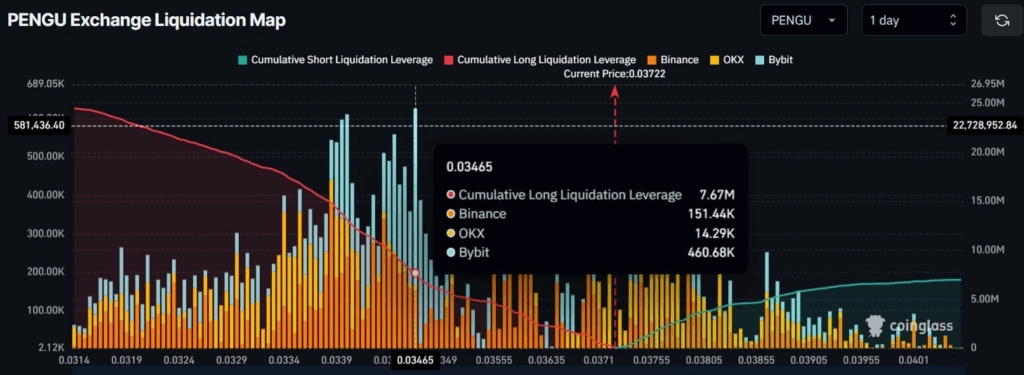

- Key liquidation levels at $0.03465 and $0.0379 could trigger short-term volatility.

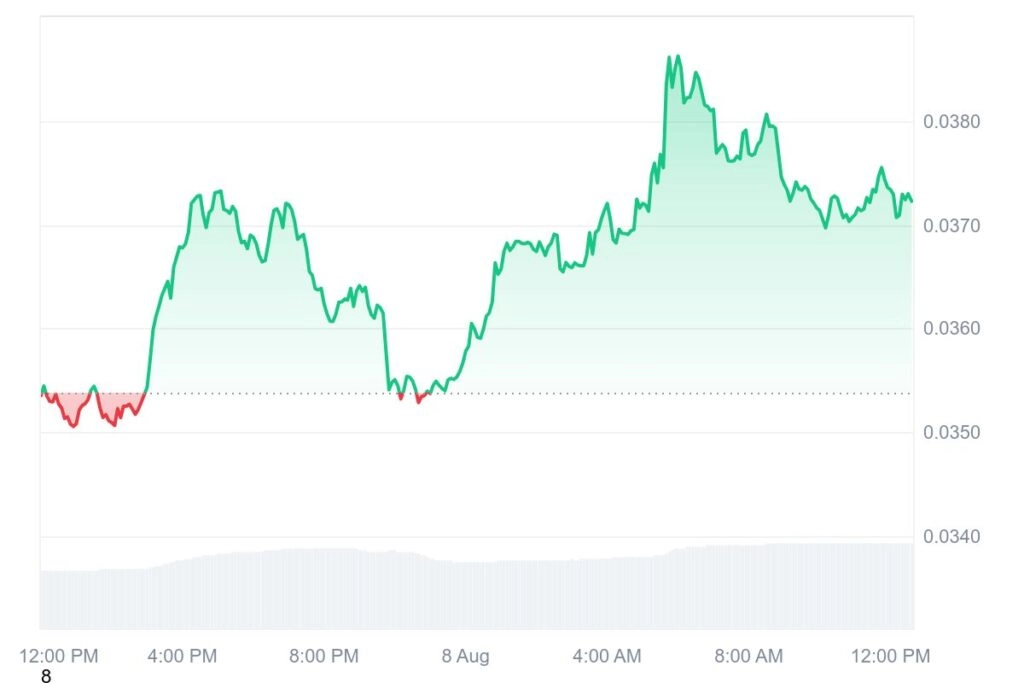

Pudgy Penguins (PENGU) is capturing significant market interest, with bullish signs piling up on both the technical and fundamental sides. Currently, PENGU is trading at $0.03722, with a 24-hour trading volume of $1.39 billion and a market capitalization of $2.34 billion. The token increased by 5.81% over the last 24 hours, extending its latest upward momentum.

Source: CoinMarketCap

Source: CoinMarketCap Popular crypto analyst Ali Maetinz highlighted that the stage is set for PENGU to escape its existing bullish flag formation, with the potential for a rally to $0.11. The key driver behind this prediction is the pending ETF application being reviewed by the U.S. Securities and Exchange Commission (SEC). Approval could trigger the gates for institutional investors and vastly improve liquidity and mainstream popularity for the token.

Source: X

Source: X To the bullish case, on-chain data by CoinGlass indicates that the last 24 hours have witnessed the withdrawal of nearly $2.10 million worth of PENGU tokens from centralized exchanges. Such exchange outflows historically serve as an indicator that these assets are being transferred to long-term storage by the investors, thus reducing the available supply within the market to create buy-side pressure.

Source: CoinGlass

Source: CoinGlass Derivative market numbers tell the same story. Longs increased tremendously, with traders netting $7.67 million of longs vs. $3.18 million of shorts, showing a clear up-pointing directional bias. The level of leverage this high is an indication that traders believe the breakout will occur within a short time frame.

Source: CoinGlass

Source: CoinGlass Also Read | PENGU Targets $0.041 Amid Rising Open Interest and Robinhood Push

Nevertheless, significant liquidation points at $0.03465 and $0.0379 need to be given focus. In case the price action turns back on the overleveraged positions, the short-term volatility could jump up. However, experts note that no significant resistance points are holding back the momentum of PENGU if the bullish sentiment continues further on.

ETF speculation, hefty spot market flows, and derivatives positioning constitute an attractive setup for additional gains. The more market participants turn bullish, the higher the probability of a big bullish price rally.

With the cryptocurrency market broadly in a place of guarded optimism, PENGUs action in the coming days presents a crucial test of its capacity to build on momentum.

Should the ETF news come out on the right side and on-chain accumulation keep coming, Pudgy Penguins may be headed to soar well beyond current heights, perhaps even to the oft-discussed $0.11 target within the near future.

Also Read | Pudgy Penguins (PENGU) Price Eyes $0.12 as Robinhood Listing Boosts Momentum