- Bitcoin and major cryptocurrencies like ETH and SOL see declines amid global economic and political tensions.

- Swissblock notes market resilience but advises caution due to increased risk and potential for ambiguous market signals.

- Aussie Analyst Jason Pizzino highlights ongoing market fear as beneficial, potentially stabilising against rapid, greed-driven fluctuations.

Bitcoin and several major cryptocurrencies are back in the red, with BTC falling 4.16% in the past 24 hours, ETH down 3.25% and SOL losing 7.81%. This comes after the market crash last Monday which caused hundreds of millions in liquidations.

Related: Thailand SEC Launches Digital Asset Sandbox to Propel Crypto Innovation

Analysts at CryptoQuant named several factors for the negative market sentiment, saying that “higher interest rates in Japan, worse-than-expected unemployment data in the USA and turmoil in the Middle East”, are some of the macro developments impacting traders.

Fears are now that we could see a repeat of last week which saw Bitcoin briefly go as low as US$49,513 (AU$75,781).

Advertisement

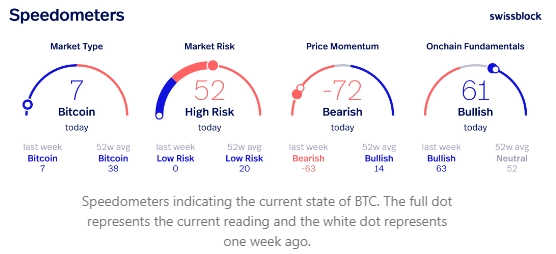

Swissblock Says Proceed with Caution

Analysts at Swissblock wrote in a note that the earlier rebound in Bitcoin and major altcoins is a sign of underlying market resilience. Despite the recovery signs, the increase in risk levels and bearish price momentum could be a point of concern. While fundamentals remain solid, the increased volatility and bearish trends suggest a cautious approach in the short term.

Swissblock added that long-term holders have increased their amount of BTC, which is a strong bullish signal for Bitcoin’s long-term value, providing a buffer against short-term market volatility.

Finally, the analysts think it’s possible that we may encounter bull and bear traps in the current market condition.

The current market condition could set the stage for bull and bear traps. Bull traps might lure traders into premature buying positions, while bearish traps could falsely signal further declines, potentially leading to unexpected rebounds.

Swissblock

Swissblock

Swissblock advises caution, highlighting the risks of entering the market based on unclear signals and the potential for significant rebounds or further declines.

Swissblock Speedometer, source Swissblock

Swissblock Speedometer, source Swissblock

The Swissblock Speedometer shows that price momentum has moved toward bearish sentiment, while on-chain fundamentals haven’t really changed.

Aussie Analyst Says Greed Not Returning Too Fast a Good Sign

Aussie analyst Jason Pizzino said on x that it’s beneficial for the market when fear persists rather than quick shifts to greed.

Related: Solana Devs Address Critical Security Vulnerability with Latest Patch as Binance Labs Boosts Restaking

His take suggests that a bit of fear can be a healthy thing for the market as it may prevent irrational exuberance and speculative bubbles, which are often followed by sharp corrections. This perspective implies a preference for stability and gradual growth over rapid, greed-driven spikes.