As Bitcoin’s dominance reaches a three-year peak at 56%, analysts are forecasting the potential onset of an altcoin season. Despite Bitcoin’s current valuation dropping below $63,600, the strong dominance level suggests a significant market shift.

Experts point out that Bitcoin’s dominance is a critical factor in predicting altcoin trends. If Bitcoin maintains its price while its dominance declines, it could signal a flow of investments into altcoins. This sparks what many refer to as an “altcoin season.”

Conversely, if both Bitcoin’s price and dominance drop simultaneously, it typically indicates a broader market correction rather than an altcoin boom.

What Factors Suggest Imminent Altcoin Season?

Markus Thielen of 10X Research noted that Bitcoin’s price tends to stabilize in August. Hence, a steady Bitcoin price, coupled with a decline in dominance, can create the ideal conditions for altcoins to thrive.

Read more: Bitcoin Dominance Chart: What Is It and Why Is It Important?

Bitcoin Dominance. Source: TradingView

Bitcoin Dominance. Source: TradingView

Sponsored

Earn up to 0.05 BTC per month with free YouHodler cloud miner with 3 easy steps:

- Create account on YouHodler: the basic miner level offers rewards for simply signing up

- Mine Bitcoin without CPU usager: Youhodler Cloud Miner operates without using any computing power from your device

- Play and earn real Bitcoin: the gamified approach of Cloud Miner makes mining enjoyable

Sponsored

Moreover, Ki Young Ju, founder of the on-chain analysis platform CryptoQuant, highlighted increasing activities by crypto whales that seem to be preparing for an altcoin rally.

“The limit buy order volume for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being set up” Ju said.

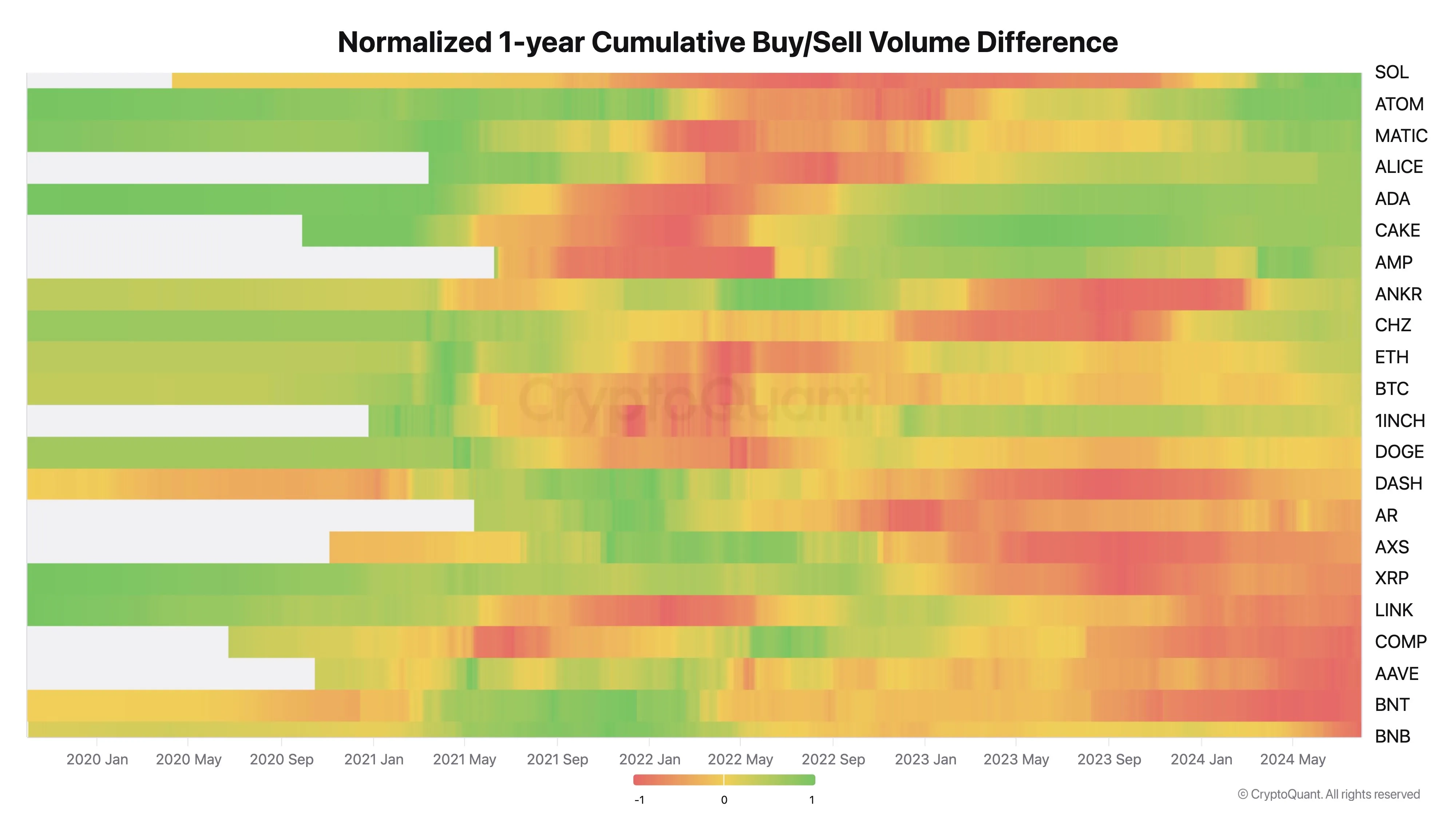

Ju explained that limit orders, which are preferred by institutions for large trades to minimize price impact, create ‘quote volume.’ His analysis, which includes a chart of the normalized 1-year cumulative buy/sell volume difference, indicates that altcoins like Solana (SOL), Cosmos (ATOM), and Polygon (MATIC) are seeing significant accumulation activities.

“The indicator is calculated by taking the cumulative sum of the difference between buy and sell quote volumes, using a 1-year moving window. If there’s an increasing trend, it means the quote buy volume is rising, indicating more strong buy walls,” Ju explained.

Normalized 1-Year Cumulative Buy/Sell Volume Difference. Source: CryptoQuant

Normalized 1-Year Cumulative Buy/Sell Volume Difference. Source: CryptoQuant

This bullish sentiment is echoed by trends following recent developments in crypto financial products. Crypto Vikings, a renowned analyst, suggests that the current market conditions are ripe for altcoin season.

“A lot of alts are down 60-80% in the last couple of months, and many of them already made their bottom and are in a good buy zone. BTC Dominance is at major resistance as well from where the massive altseason started every cycle,” Crypto Vikings stated.

The sentiment is increasingly optimistic, as many believe that the disillusionment following prolonged downturns sets the stage for profitable investments.

Another trader, Mags, noted that the altcoins are up just 58% after breaking out of a 525-day accumulation. Hence, he predicts an eventual continuation of the altcoin rally after a re-accumulation consolidation.

“Perma bears will tell you altcoins are done and are in a distribution phase. But if you look at the chart, altcoins are only up 58% since they broke out after 525 days of accumulation. Do you really think a breakout after 525 days of consolidation will end after just a 58% move?” Mags wrote on X (Twitter).

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

In contrast, Brian Quinlivan, the lead analyst at Santiment, told BeInCrypto that there is a lack of enthusiasm for the altcoin season due to recent price dips.

“As for mentions of altcoin season, we aren’t really seeing any significant trader enthusiasm for it. Traders have at least been a bit more vocal since we started seeing prices dip over the past 3 days,” Quinlivan told BeInCrypto.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.