- FET is consolidating near $0.6500 with Bollinger Bands tightening, signaling a possible breakout.

- A bullish MACD crossover suggests early upside momentum despite neutral RSI.

- Reclaiming $0.718 is crucial to reversing the short-term bearish trend.

Fetch.ais native token FET is consolidating around the $0.6500 mark after a modest 0.87% uptick in the latest session. While the token is still down 4% over the past week, tightening technical indicators suggest that a significant price move may be on the horizon. As traders await confirmation, all eyes are on key resistance and support levels that could determine the next trend.

Source: CoinMarketcap

On the 4-hour chart, the token is trading just above the 20-period simple moving average of the Bollinger Bands, which currently sits at $0.64775. The upper and lower bands are compressed at $0.66587 and $0.62963, respectively, highlighting reduced volatility and a potential squeeze setup.

The Relative Strength Index (RSI) holds steady at 50.12, reflecting a neutral momentum stance. However, the MACD has printed a bullish crossover, with the MACD line at +0.00168, signal line at -0.00169, and a histogram reading of +0.00337, indicating early upside momentum.

Fetch.ai (FET) Price Eyes Breakout as Bollinger Bands Squeeze Near $0.65 5

Fetch.ai (FET) Price Eyes Breakout as Bollinger Bands Squeeze Near $0.65 5 Source: Tradingview

Volume remains muted at 735.96K, suggesting traders are awaiting clearer signals before committing capital. A surge in buying pressure will be needed to confirm any breakout attempt.

Also Read: Fetch.ai (FET) Forms Bullish Pattern: Cup & Handle Hints at $1.40 Rally

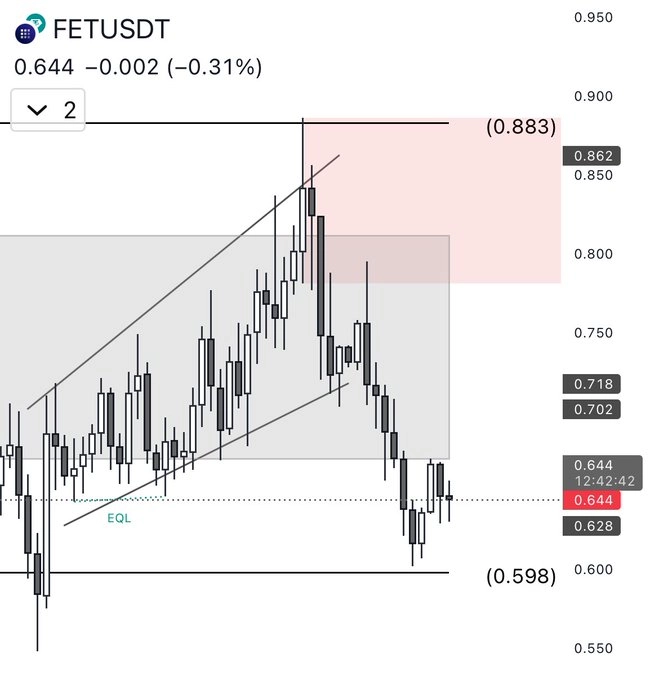

Crypto analyst Bullis Banter highlighted that the token has broken down from its rising channel and is struggling to regain upward momentum. It was rejected from the $0.702$0.718 zone and continues to trade below critical resistance.

Source: X

Short-term trend remains weak unless bulls reclaim control above $0.718, he noted, citing $0.628 and $0.598 as next lines of defense.

If the token can close above the $0.67 resistance with a clear rise in volume, a breakout toward $0.70 and potentially $0.718 could unfold. On the flip side, failure to hold above $0.63 may expose the token to a further decline, with support levels at $0.598 and $0.55 likely to come into play.

Also Read: Fetch.ai (FET) Breaks Out of Slump, Sets Sights on $2.00 Zone