![]()

contributor

- BlackRock bought ETH worth $109.9 million, spurred by the latest price decline.

- Slight accumulation observed, especially from whales, but retail is still fearful.

With the latest discounted Ethereum [ETH] prices, one would expect buyers to ape back into the market.

Unless there were expectations of more sell side pressure in the coming days. ETFs have been driving up demand for ETH, hence it is essential to keep up with their activity.

Recent data indicated that the bears were falling back after their aggressive assault on the market last week. Some Bitcoin [BTC] ETFs are taking advantage, such as BlackRock, who bought ETH worth $109.9 million on the 6th of August.

This was a sizable increment, compare to the amount that Blackrock purchased in the previous day.

Source: farside.co.uk

Blackrock had previously halted accumulation on the 2nd of august as sell pressure intensified. It resumed on the 5th of August, during which it added $47.1 million worth of ETH.

There was $98.4 million net buying pressure on that day, compared to $48.8 million during the previous day.

This increase in the last two days signals the return of confidence after the recent crash. It also indicates that the ETFs are capitalizing on the ETH price discount.

Nevertheless, most of the other ETH ETFs have either been sitting on the sidelines or adding smaller amounts.

The most notable on the opposite side of the spectrum was the Grayscale ETHE ETF, which has been experiencing outflows. It also happens to be the ETF with the highest annual fee at 2.5%.

It contributed $39.7 million worth of sell pressure during the trading session on the 6th of August.

Outflows have notably reduced compared to the last week of July, indicating disinterest in selling at discounted prices.

Is ETH accumulation gaining traction?

ETH has no doubt been experiencing a resurgence of sell pressure in the last two days. But just how much buying pressure currently exists?

We compared ETH concentration before and after the crash, and here’s what we found.

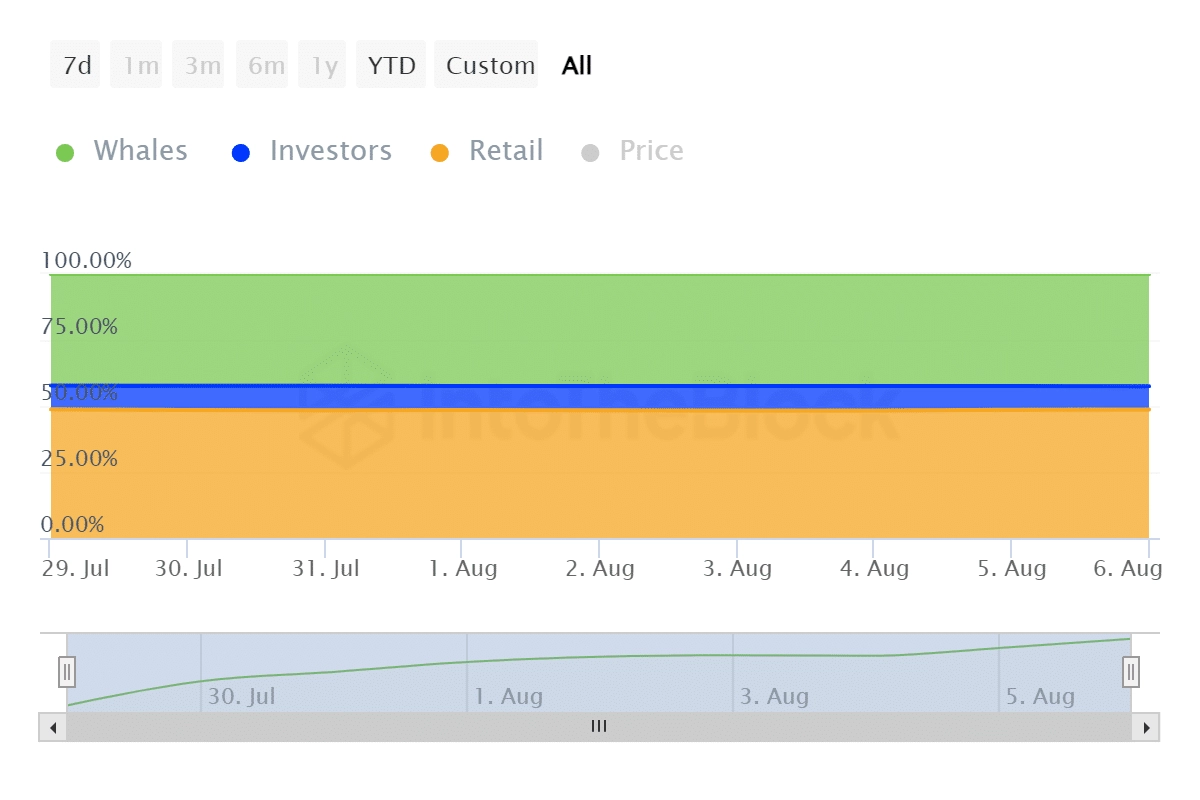

Just seven days ago, whales owned 56.66 million ETH, investors held 12.2 million ETH and retail traders held 65.43 million ETH. This represented 42.19%, 9.09% and 48.72% respectively.

The latest data indicated that whales held 57.13 million ETH, investors at 11.93 million ETH and retail was at 65.39 million.

Source: IntoTheBlock

The above findings indicated that whales added to their holdings during the dip. Investors and retail traders, at press time, were holding less ETH than they did a week ago.

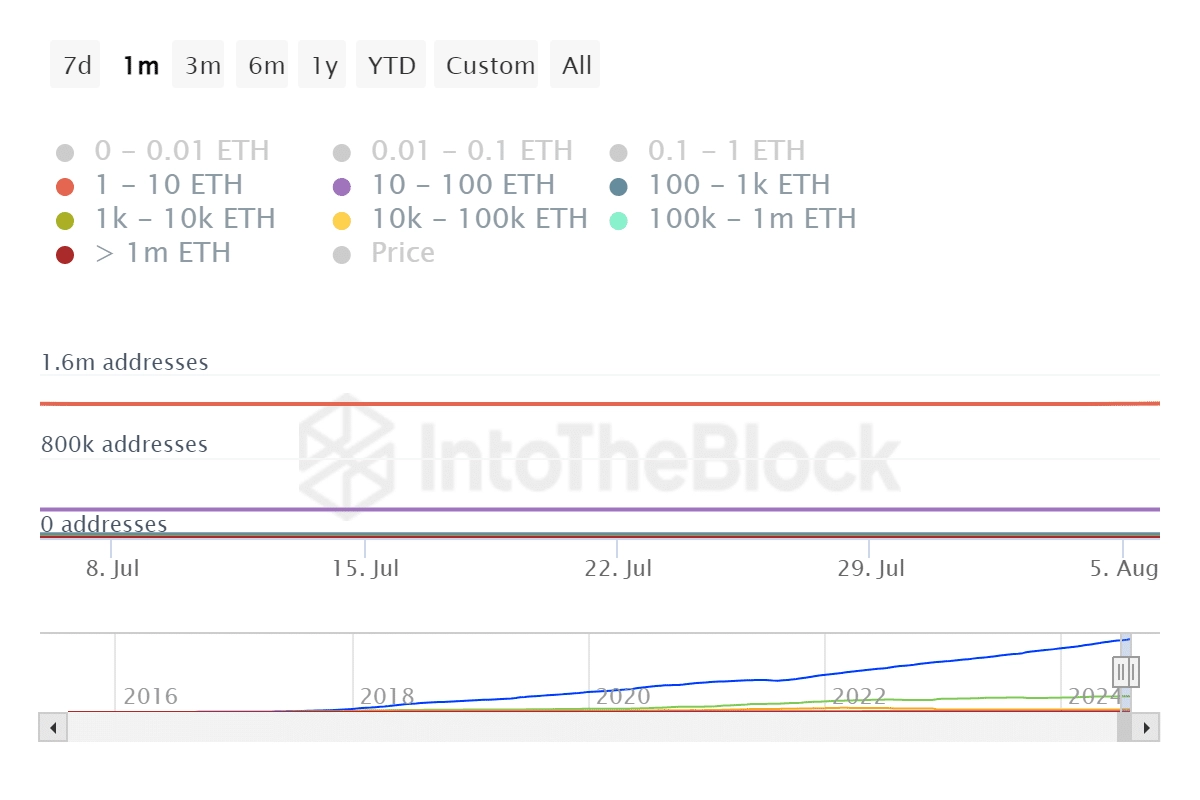

We also decided to explore address holdings to determine which class of whales were accumulating.

Source: IntoTheBlock

Read Ethereum’s [ETH] Price Prediction 2024-25

Our findings revealed that there were five addresses owning over 1 million ETH during the last 30 days. Addresses holding between 100,000 ETH and 1 million ETH dropped from 93 to 92.

Those in the 10,000 t0 100,000 ETH range dropped by 32 addresses. The category of addresses holding between 10 and 100 ETH had a net positive outcome from 281,750 addresses to 282,530 addresses.