For years, the dominant storyline in Africas fintech sector has been growth fast, aggressive, and often exhilarating. Startups raced to onboard users, launch new features, and expand across categories and geographies, all while inching closer to profitability. In those early days, the story made sense. The sector was carving out its legitimacy, disrupting entrenched institutions, and bridging long-standing gaps in access and user experience.

But that narrative is shifting, regulation is tightening, and Investors are asking more sophisticated questions. And perhaps most importantly, the costs of weak foundations, particularly around compliance, are becoming too visible to ignore. In this new phase, a different kind of edge is emerging; it is called discipline!

Startups that once prioritised speed above all else are learning that sustainable scale doesnt come from velocity alone. It comes from structure. That is clear governance, robust risk awareness, and the ability to anticipate and adapt. Increasingly, the fintechs best positioned to grow are not the ones who moved first, but the ones who built right.

This shift hasnt happened in isolation. In 2024, the Central Bank of Nigeria (CBN) sanctioned several high-profile fintechs for compliance failures, particularly related to Know Your Customer (KYC) and anti-money laundering (AML) processes. These were not fringe players; they were among the sectors most recognisable names.

To many, like myself, closely following the industry, the message was unambiguous: regulatory expectations have now caught up with the scale of the industry. Simply put, the grace period is over.

Today, fintechs are being held to standards once reserved for traditional banks. Standards that span transaction monitoring, suspicious activity reporting, data protection, and financial crime prevention. The scrutiny has shifted from being sporadic to routine. Its now data-driven and enforced through increasingly sophisticated mechanisms within the CBN, Nigerian Financial Intelligence Unit (NFIU), Securities and Exchange Commission (SEC), and others.

And rightly so. The era of fintechs operating like the Wild West must give way to one of structure and accountability. The sector has matured, and it now requires a regulatory framework that balances innovation with consumer protection.

Encouragingly, a growing number of founders are beginning to embrace this shift. Compliance, once viewed as a bureaucratic burden or cost centre, is now being recognised as a mark of seriousness. One notable example I recently came across is a less than 5-year-old African fintech that recently announced its credit rating approvals from agencies like DataPro, GCR (Moodys), and Agusto & Co. That kind of public declaration remains rare in African startup circles, but its telling. Strong compliance is no longer a footnote; its becoming a competitive signal. It reassures investors, attracts more stable partnerships, and builds long-term credibility with regulators and customers alike.

In truth, compliance is infrastructure. Much like payments rails or identity verification systems, it underpins growth at scale. Fintechs that neglect it early often face costly consequences down the road, regulatory sanctions, reputational hits, or interrupted product rollouts. By contrast, those that invest early in transaction monitoring, scalable reporting, and board-level governance structures tend to move faster, and more sustainably, in the long run.

Still, some challenges persist, particularly around KYC and onboarding. Nigerias identity infrastructure remains particularly fragmented. Despite efforts to unify systems like BVN, NIN, and SIM registration, gaps endure. This poses a real challenge for fintechs, especially those serving underserved or informal populations where standard documentation is scarce.

Nonetheless, some AI-powered KYC tools are beginning to help. Companies now offer real-time verification that reconciles multiple ID sources and flags inconsistencies. These tools have meaningfully reduced onboarding time and improved fraud detection. But technology alone isnt enough. Without broader improvements in public infrastructure, cleaner data, better inter-agency coordination, and more inclusive ID frameworks, there are limits to what any solution can solve. This is where discipline again becomes essential. Fintechs must be realistic about what automation can do, and deliberate in building human-led controls that complement their tools.

The other major force driving compliance maturity is capital. Investors, especially institutional ones, are no longer swayed by user numbers alone. They want to see operational integrity: risk frameworks, internal audits, clear licensing, and engaged boards. In todays environment, a startup with 10 million users but no escalation process for suspicious activity is no longer a darling. Its a red flag. Conversely, startups that can demonstrate a well-structured, evolving compliance culture are not just avoiding risk theyre gaining leverage. Theyre securing better financing terms, earning the trust of banking partners, and accelerating market access. Discipline, it turns out, isnt a constraint. Its a differentiator.

The early days of Nigerian fintech were defined by speed. But today, discipline is what will separate the players from the leaders.

Scaling with discipline doesnt mean slowing down. It means building the kind of systems that can carry weight, withstand shocks, and support greater velocity when its time to accelerate. As one fintech CEO put it: Its like loading a Toyota with the capacity of a Ferrari, so that when the time comes to drive like a Ferrari, youll be ready.

For founders, its a mindset shift. For the ecosystem, its a sign of maturity. For the country, its a pathway to a resilient digital economy, one that doesnt just grow quickly, but grows well.

________

Kayode Opeyemi is a fintech and risk compliance expert with a background in corporate finance, technology, and innovation management. He most recently served as an Assistant Manager at KPMG UK, where he led projects spanning internal audit, financial governance, and enterprise risk across sectors including banking, healthcare, and consumer markets. He helps organisations navigate complex regulatory landscapes, delivering solutions that drive resilience, operational efficiency, and sustainable growth. He is especially passionate about helping fintechs scale responsibly by embedding strong compliance frameworks from day one.

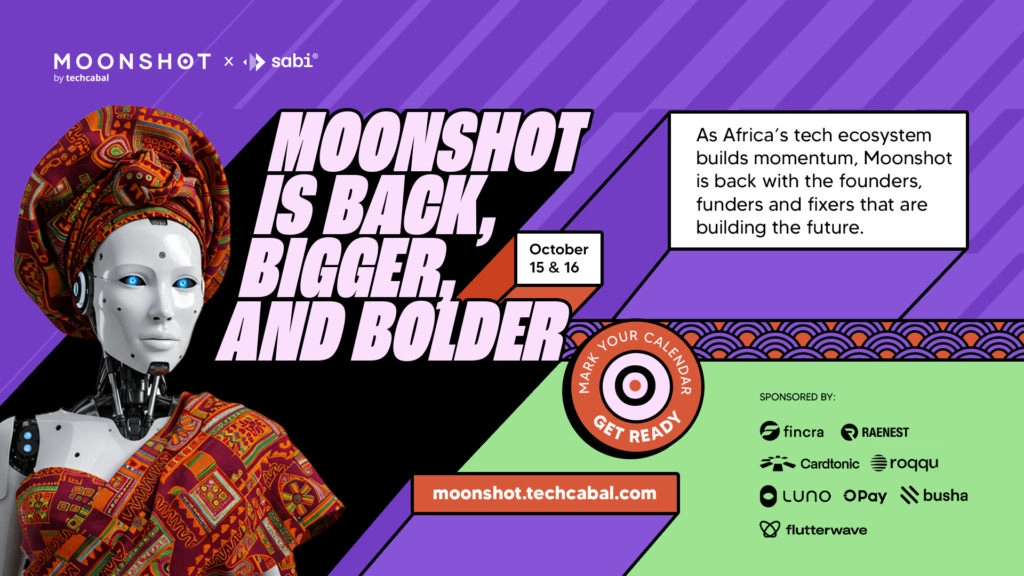

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 1516! Join Africas top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% offdont snooze! moonshot.techcabal.com