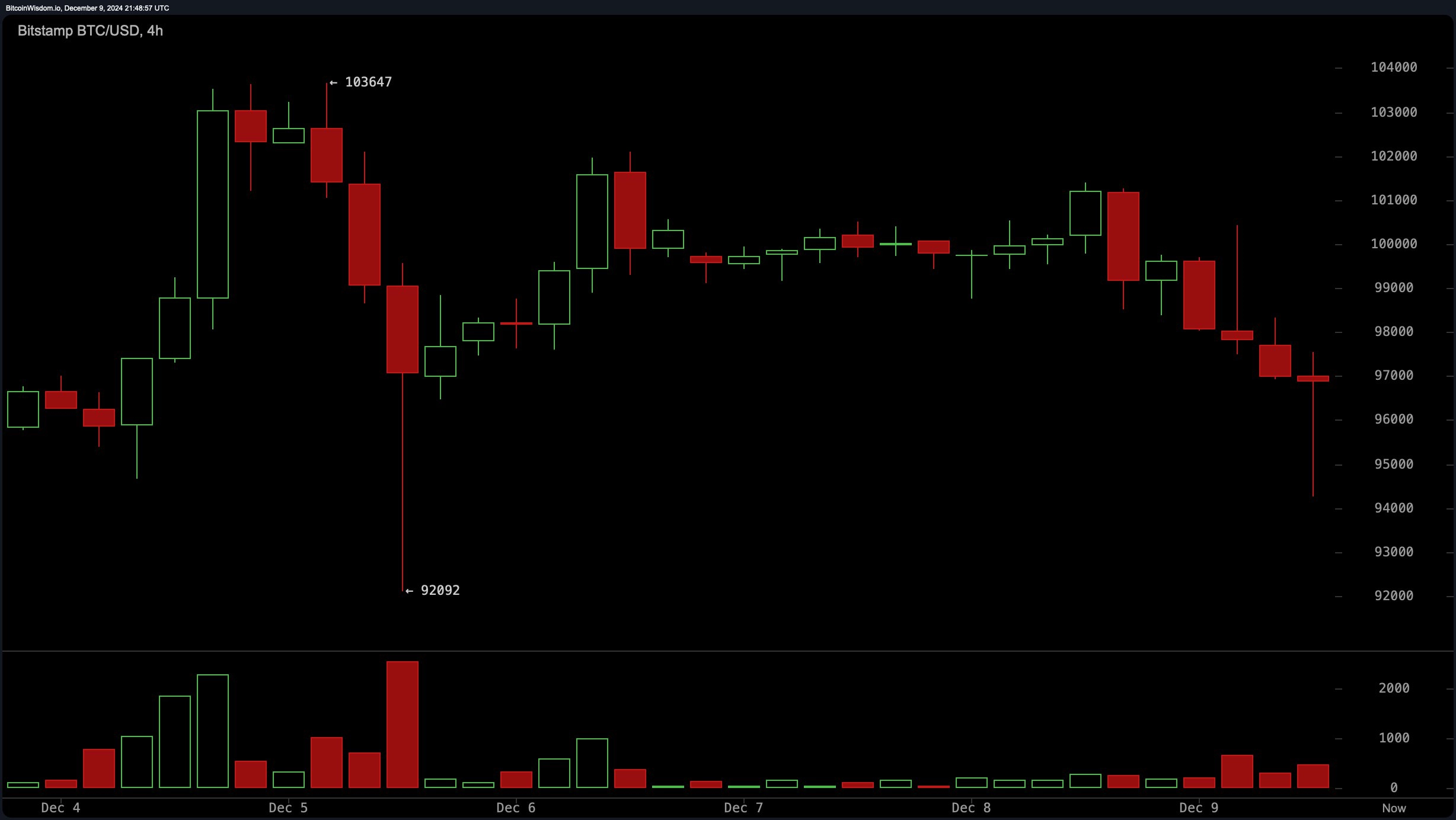

Monday proved to be a tough day for cryptocurrency markets, with the crypto economy shrinking by 6.31% in just 24 hours and $1.5 billion in crypto derivatives positions vanishing. Bitcoin (BTC) found itself hanging on between $96,800 and $97,000 per coin, though it briefly plummeted to $94,249, setting off the turmoil.

Bitcoin Flash Crash Causes Altcoin Avalanche: Double-Digit Losses Slam the Crypto Economy

Bitcoin took a sudden nosedive after hovering at $97,748 per coin. In mere moments, the price tumbled to $94,249, leaving the top cryptocurrency struggling to regain footing in the $97,000 zone. The ripple effect of this price drop left the broader crypto market reeling, with many other assets taking even heavier hits.

For instance, while BTC saw a 3.5% dip when the dust settled, ether (ETH) dropped 7%, and XRP plunged by more than 11%. Solana (SOL) fell 6.5%, Binance coin (BNB) slipped 7.48%, and dogecoin (DOGE) shed 8.92%. Losses piled up across the board, with most digital assets suffering double-digit drops. Tokens like PNUT and DYDX faced brutal declines of 22% and 21%, respectively, while GALA saw its value slashed by more than 20% during the day.

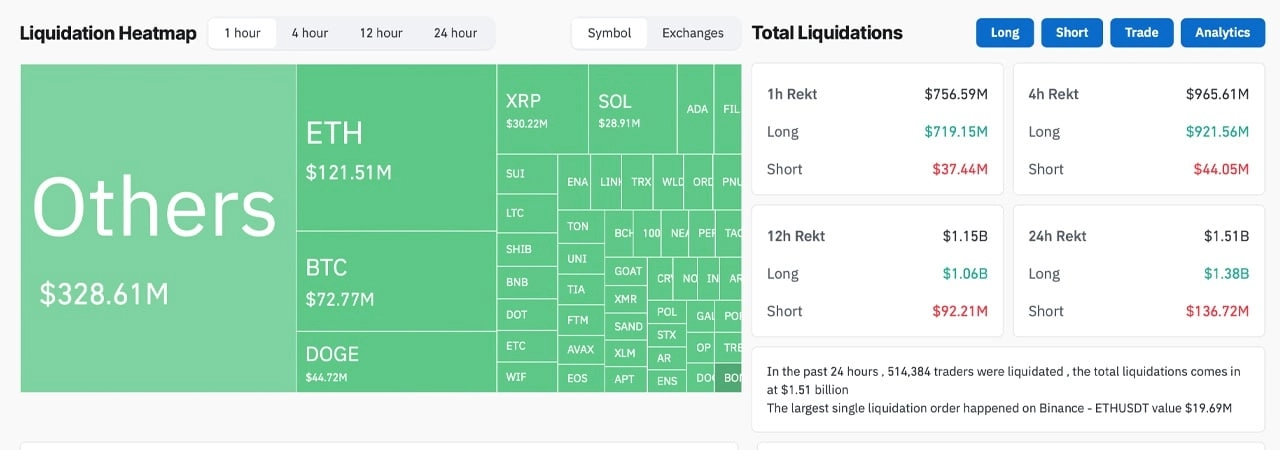

Monday was not a good day for long positions.

Monday was not a good day for long positions.

One undeniable takeaway from the chaos is that the crypto derivatives market took a massive hit. Data from coinglass.com revealed $1.51 billion in positions—both long and short—were wiped out, with $1.38 billion of these being long bets. The carnage affected 514,384 traders during the trading sessions, with altcoins bearing the brunt of the losses, accounting for nearly two-thirds of the liquidations.

The recent market turbulence highlights the fragility of crypto valuations, where rapid price swings can swiftly erase gains and intensify trader losses. As altcoins bore the brunt of the liquidation cascade, the event underscores the importance of risk management strategies in the derivatives market. Traders are reminded that volatility in digital assets remains a significant challenge.

This widespread downturn serves as a stark reminder of the unpredictable forces at play in the crypto economy during bull runs. With liquidations mounting and prices faltering, market participants face tough questions about long-term stability and speculative risks. For now, the sell-off has left a scar that may influence trading behavior in the days ahead, emphasizing caution over-exuberance.

By 4:45 p.m. EDT on Dec. 9, bitcoin (BTC) had clawed its way back to $97,294 per coin, leaving other cryptocurrencies nursing their deep losses in the aftermath. A few minutes later at 4:49 p.m. EDT, BTC was once again struggling to hold $97K. Interestingly, the ‘Altcoin Season Index’ (ASI) indicates that it’s no longer “altcoin season,” with the score slipping below the 75 threshold to hit 69 today.