Mike Intrator, co-founder and CEO of CoreWeave, speaks at the Nasdaq headquarters in New York on March 28, 2025.

Mike Intrator, co-founder and CEO of CoreWeave, speaks at the Nasdaq headquarters in New York on March 28, 2025. CoreWeave shares slid 9% in extended trading on Tuesday even as the provider of artificial intelligence infrastructure issued results and guidance that beat expectations.

Heres how the company did in comparison with LSEG consensus:

- Earnings per share: Loss of 21 cents

- Revenue: $1.21 billion vs. $1.08 billion expected

Revenue more than tripled from $395.4 million a year earlier, CoreWeave said in a statement. The company registered a $290.5 million net loss, compared with a $323 million loss in second quarter of 2024. CoreWeaves earnings per share figure wasnt immediately comparable with estimates from LSEG.

Revenue growth continues to be capacity constrained, with demand outstripping supply, Nitin Agrawal, the companys finance chief, said on a conference call with analysts. The company competes with cloud providers such as Amazon to rent out Nvidia chips to companies.

CoreWeaves operating margin shrank to 2% from 20% a year ago due primarily to $145 million in stock-based compensation costs. Debt now sits at $11.1 billion. This is CoreWeaves second quarter of full financial results as a public company following its IPO in March.

On a conference call with analysts, CoreWeave CEO Mike Intrator pointed to an expansion in business with OpenAI, a major client and investor, and he said Goldman Sachs and Morgan Stanley are becoming customers. Both banks were underwriters in CoreWeaves March initial public offering.

During the quarter, CoreWeave acquired Weights and Biases, a startup with software for monitoring AI models, for $1.4 billion.

In May, management touted 420% revenue growth, alongside widening losses and nearly $9 billion in debt. The stock still doubled anyway over the course of the next month.

For the third quarter, CoreWeave anticipates $1.26 billion to $1.30 billion in second-quarter revenue. Analysts surveyed by LSEG were looking for $1.25 billion.

CoreWeave now sees $5.15 billion to $5.35 billion in revenue for all of 2025, suggesting a 174% growth rate. The new range is up from the $4.9 billion to $5.1 billion forecast that management gave in May. Analysts polled by LSEG had expected $5.05 billion in 2025 revenue.

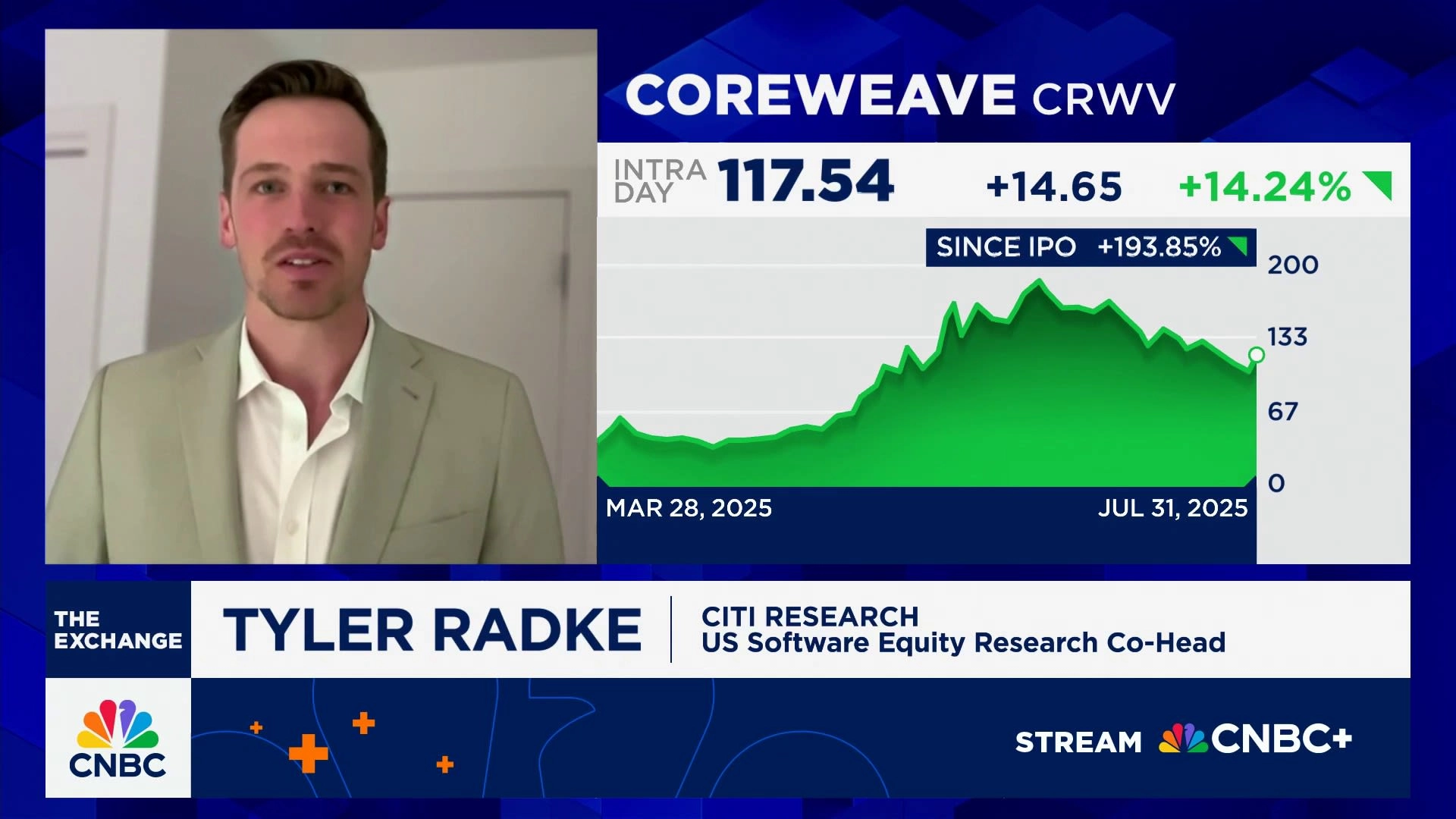

The companys shares debuted on Nasdaq at the end of the first quarter, after it sold 37.5 shares at $40 each, yielding $1.5 billion in proceeds. As of Tuesdays close, the stock was trading at $148.75 for a market cap of over $72 billion.

A CoreWeave data center project in New Jersey with up to 250 megawatts of capacity is set to be delivered in 2026, the company said in the statement.

Intrator said later this year CoreWeave aims to start letting people rent out GPUs on a spot basis. That means CoreWeave can quickly take back GPUs from customers if the company decides theyre needed elsewhere, but costs are lower than they would be when bought on demand.

WATCH: Citis Tyler Radkes bullish call on CoreWeave, upgraded to buy