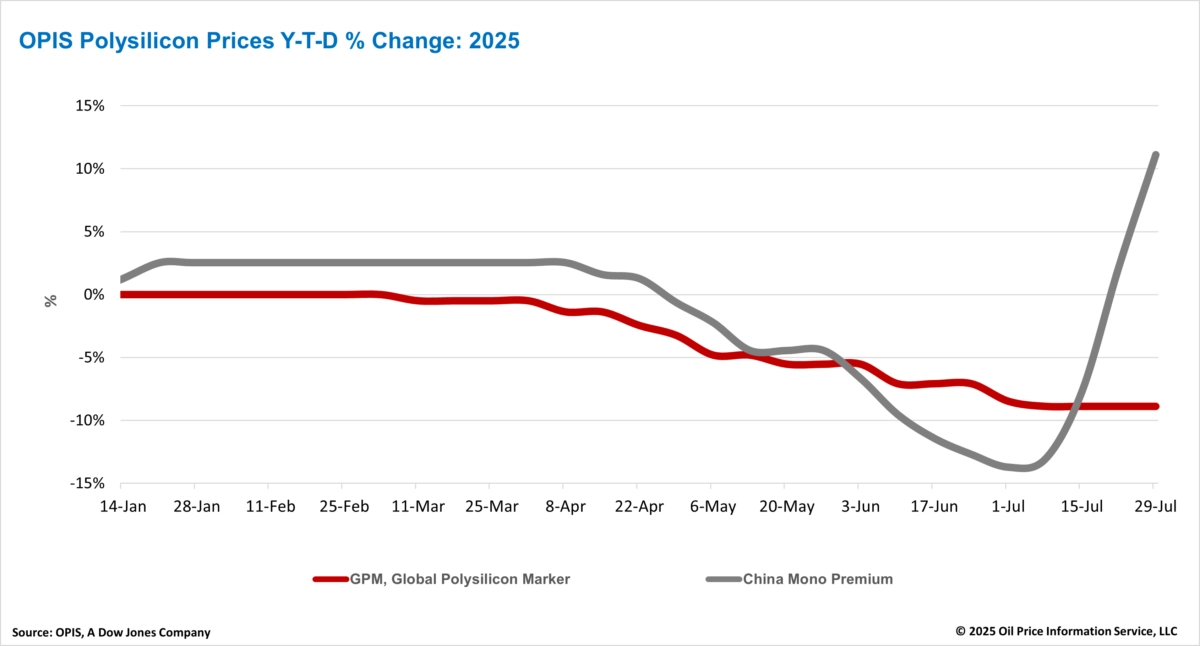

The China Mono Premium OPIS' assessment for mono-grade polysilicon used in N-type ingot production increased by 8.70% week-on-week to CNY 43.750/kg, or CNY 0.092 ($0.013)/W, according to OPIS Solar Weekly Report released on July 29.

Polysilicon prices in China rose for the fourth consecutive week, driven largely by government directives to address below-cost pricing. According to market sources, bundled transaction prices for N-type and P-type polysilicon have reached approximately CNY 42/kg this week, with some smaller-volume N-type transactions seen reaching as high as CNY 49/kg.

Industry sources point to aggressive stockpiling by two major wafer manufacturers as amplifying the government-driven rally, with the companies reported to have accumulated over 100,000 metric tons (mt) and 60,000 mt of polysilicon respectively.

Polysilicon futures market activity is also supporting recent price increases. According to Guangzhou Futures Exchange (GFEX), on certain days, market participants observed the total open interest exceeding one million metric tons representing 70-80% of China's annual polysilicon capacity. GFEX data from July 28 also shows that futures contracts for September 2025 delivery recorded a single-day trading volume of 1,744,380 mt the highest volume among all 2025 delivery contracts on that day. While the elevated futures market activity can temporarily reduce inventory availability and tighten market liquidity, sources caution that it cannot fundamentally address the persistent oversupply.

However, trade information indicates two major producers have begun raising their operating rates to capitalize on higher margins. Given the sustained weak end-market demand, market participants view this as a dangerous signal, with some warning that any unfavorable market development could quickly trigger another price decline.

In a separate development, Chinese authorities are reportedly planning to introduce stricter energy consumption standards for polysilicon production. The proposed revisions aim to redefine effective production capacity and accelerate the phase-out of outdated facilities by tightening energy consumption thresholds.

Some industry experts have expressed skepticism regarding the effectiveness of this measure. One expert commented that imposing stricter energy consumption thresholds may be redundant as producers who cannot meet the energy consumption threshold are those who lack the financial resources for technological advancements already struggling to remain operational.

The Global Polysilicon Marker (GPM) the OPIS benchmark for polysilicon produced outside of China remained stable this week at $18.550/kg, or $0.039/W, based on reported buy-sell indications.

Market fundamentals remain relatively stable; however, two potential developments in U.S. trade policy may influence future polysilicon demand.

A national security investigation into polysilicon imports, launched by the U.S. Department of Commerce on July 1, could boost demand for non-Chinese polysilicon. Industry insiders anticipate that if the probe results in the classification of Chinese polysilicon as a national security threat, downstream manufacturers may pivot to alternative global suppliers.

In a separate development, a petition filed on July 16 by a coalition of solar manufacturers is expected to trigger new anti-dumping and countervailing duty investigations into solar cells and modules from Laos, Indonesia, and India.

Chinese-invested manufacturers in these regions are expected to significantly scale back production once an investigation is launched, as any resulting tariffs could apply to all shipments made from the investigation's start date. Such a development could dampen demand for global polysilicon in the medium term.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the authors own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: [email protected].