- Chainlink price surges 33.15% weekly and 8.93% in 24 hours, trading at $21.13 with $14.33B market cap.

- Whales accumulate over $150M in LINK, signaling long-term bullish confidence and strengthening market momentum.

- Breakout from multi-year triangle pattern sets sights on $35$100 targets, with some eyeing $230 if momentum continues.

Chainlink (LINK) is embarking on a stunning bullish run that has attracted shorter-term traders and longer-term speculators. The token behind the decentralized oracle system has appreciated 8.24% within the past 24 hours, and its performance over the last week is more impressive, having appreciated 33.15%.

Currently, LINK is trading at $20.95, supported by a 24-hour volume of $2.64 billion and a market valuation of $14.33 billion. The current price movement is maintaining its ranking as one of the highest-performing major altcoins this month.

Source: CoinMarketCap

Source: CoinMarketCap Prominent crypto analyst Ali Martinez noted that the rise is supported by strong whale accumulation. Since two weeks ago, deep-pocketed investors have accumulated above 8.10 million LINK, valued at above $150 million, which is a positive signal towards the long-term prospects of the asset.

Source: X

Source: X Aiding the bullish thesis, Crypto Patel also noted that Chainlink has supposedly escaped a multi-year triangle formation on the bi-weekly (2W) timeframe after years of basing.

The breakout has excited prospects for a significant jump in the present cycle, and primary support levels lie at $16$17. Support above this range could open the door to $35, $50, and even $100 over the coming months.

Source: X

Source: X Chainlinks Insane growth is on the heels of renewed focus towards blockchain infrastructure play, where the protocols roles as a bridge between on-chain smart contracts and off-chain data are increasingly becoming a necessity towards DeFi, tokenization, and bringing real-world assets on-chain.

If sustained buying pressure is sustained, LINK could be gearing up for one of its strongest cycles during the course of the marketplace since the 2020-2021 surge.

Also Read | Chainlink Launches Strategic LINK Reserve to Support Network Growth and Stability

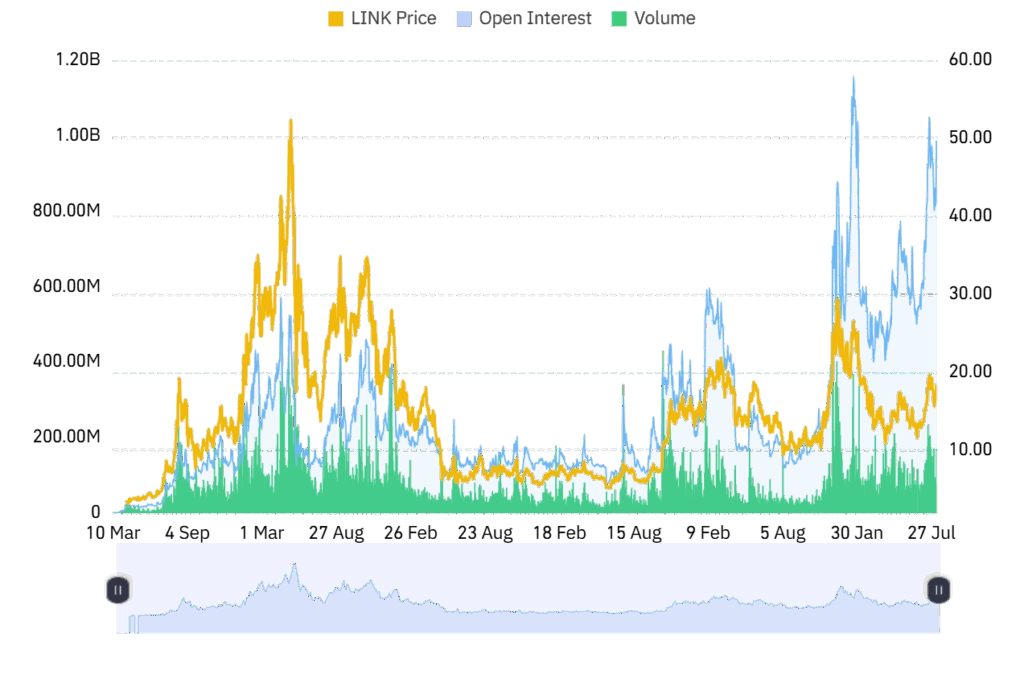

Chainlink (LINK) has observed a rapid increase in market activity, where Open Interest increased 13.90% to $1.24B as bulls increased positions, and spot volume increased 2.05% to $2.96B, providing a boost to liquidity. Such a confluence of increased OI and volume tends to be a harbinger for greater future price movement.

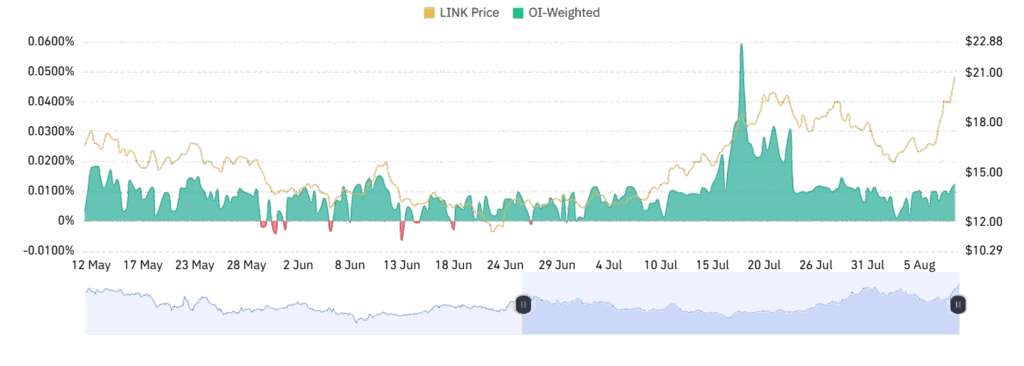

Source: Coinglass

Source: Coinglass The OI-weighted funding rate is 0.0125%, showing minor bullish bias without over-leverage. Such well-balanced positioning can keep rallies going should momentum persist, and since OI and volume are up, LINKs target on the upside is still achievable.

Source: Coinglass

Source: Coinglass Also Read | Chainlink Price Prediction 2025: Will LINK Break Its $52 All-Time High?