Does your company do worst-case scenario planning? What will you do if the rule of law erodes and corruption accelerates?

The year 2024 is set to be one of the biggest and most important election years in history. It comes at a time of global instability, where there is, once again, a war in Europe, and the post-World War II international order itself is under strain. Although decentralized technology cannot provide meaningful protection against a total collapse of the rule of law, such a scenario remains unlikely.

Nevertheless, erosion of the rule of law is still possible. There are several areas where extreme political actions could undermine businesses and investors that depend on predictable and stable environments, leading to significant problems for companies. I identify three risks in particular that can at least be offset by careful application of decentralized technology:

-

The one that most blockchain boosters think about right away is currency manipulation. From printing money to finance deficits to pre-election spending splurges, central banks and treasuries face a lot of political risk. Shifting away from volatile local currencies to stablecoins is the most practical alternative for businesses. Keeping as little of volatile local currency as possible is advisable, where it is legally permitted.

-

Another big risk is political interference in the judiciary. Courts are where people go to resolve disputes, and if the umpires are corrupt, the risk of a bad or unfair outcome is high. The best option is to stay out of politically compromised courts as much as possible. Moving from paper contracts to transparent, blockchain-based smart contracts that are enforced automatically offers an opportunity to reduce the risk of nonpayment or disputes. Furthermore, it increases the likelihood of automated and fact-based dispute resolutions.

-

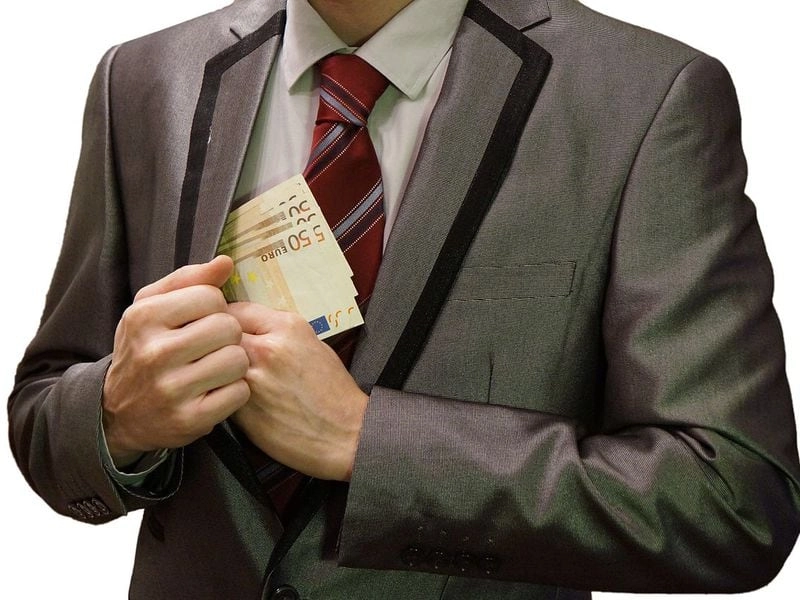

Corruption at all levels is another big risk, internally and externally. Corrupt officials often pursue arbitrary regulatory actions or selective and extreme enforcement against firms that won’t play ball. Their best ally in this process is opacity. Corruption is never popular, and bad actors rely on others' silence to get away with their behavior. The best protection against this kind of rent-seeking is extreme and total transparency. If all your orders, shipments, purchases and prices are public, then theft is immediately visible to all.

This last practice, extreme transparency, is something businesses in mature economies would hesitate to embrace, but it’s a real and proven strategic option. In the Indian state of Maharashtra, cooperative farmers at the Sahyadri Farmers Producer Company , frustrated with the immensely variable prices and wildly different markups by middlemen, put all their shipments and prices on the Polygon blockchain with the help of a local startup, Emertech. The result: lower overheads and fairer prices for all involved.

Most companies, especially big ones, have little choice other than to play by the rules, however arbitrary they might be. This is one of the reasons cryptocurrency adoption in many countries by consumers has far outpaced that by enterprises. Governments generally do not have the power to prosecute every consumer for every infraction. Exchanging your local currency for crypto or stablecoins may not be legal, but individuals can often fly beneath the radar. Businesses, however, have real-world assets, such as real estate and factories of immense value, that can be seized as penalties.

Blockchains and cryptocurrency can only mitigate some of the big political risks faced by enterprises in the coming years. But, to make money, you must take risks, and that means having assets, people and resources in the market, and accepting the ups and downs that come with it. No risk, no reward.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Edited by Benjamin Schiller and Marc Hochstein.

State of Crypto

Sign up for State of Crypto, our weekly newsletter examining the intersection of cryptocurrency and government

By clicking ‘Sign Up’, you agree to receive newsletter from CoinDesk as well as other partner offers and accept our terms of services and privacy policy.

Disclosure

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Paul Brody is Global Blockchain Leader for EY (Ernst & Young). Under his leadership, EY is established a global presence in the blockchain space with a particular focus on public blockchains, assurance, and business application development in the Ethereum ecosystem.