You are here: Home / News / Bitcoin’s $1.7B Exchange Exit: Whales Bet Big on Long-Term Gains

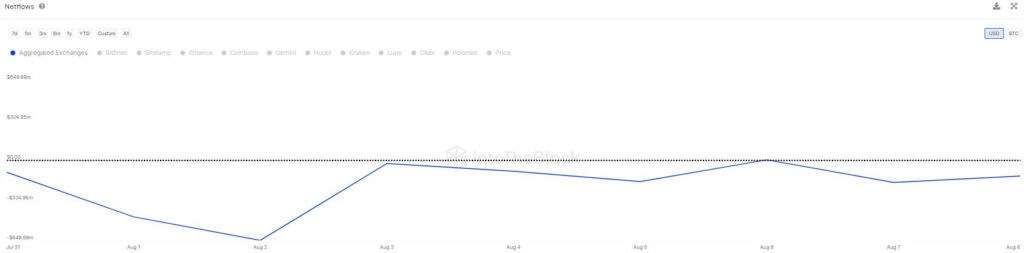

According to IntotheBlock, Bitcoin (BTC) recorded an impressive $1.7 billion in net outflows from exchanges, and this is the highest in over a year. Such a large movement indicates that whales are buying more BTC during the recent market fall.

Such actions usually refer to those big investors, who are known as people who put in large sums of money, like whales, who are grabbing the dip to buy BTC. These actions, irrespective of the short-term price changes that lead to smaller investors’ concerns, are evidence of the traders’ commitment to Bitcoin, which, in turn, will surely bear fruit for the market.

Source: IntotheBlock

Source: IntotheBlock

Despite Bitcoin’s recent challenges, some analysts remain optimistic. One such voice is Mags, who pointed out that while Bitcoin’s short-term performance might appear shaky, the broader perspective remains promising. BTC has consistently held above the crucial $60,000 support level on the monthly chart.

#Bitcoin

Many people might say that Bitcoin is struggling when looking at lower time frames. However, the long-term view still looks promising.

On the monthly chart, the price hasn't closed below the $60,000 support level. Every time the price dips below $60,000, it quickly… pic.twitter.com/ktYL9mvwzy

— Mags (@thescalpingpro) August 10, 2024Every dip below this threshold has been met with a quick rebound, suggesting strong buying interest at these levels. Mags emphasizes that these short-term drops could be misleading and might simply be setting the stage for another upward surge, urging investors not to be swayed by temporary market noise.

Bitcoin’s July Performance: Gains, Losses, and Fear

Adding to the discussion, expert David Puell shared insights on Bitcoin’s performance in July, noting a 3.1% increase to $64,612. However, by August 5, Bitcoin had corrected sharply, losing 23.3% and hitting a new local low of $49,577. This correction saw Bitcoin briefly regain, then lose, its 200-day moving average and short-term holder cost basis, signaling increased volatility.

As the Bank Of Japan ramped up its hawkish action and rhetoric, the yen—the world’s third-most traded currency—began to appreciate rapidly. The strong and sudden reversal of the yen relative to the dollar created fear that the more than ten-year yen carry trade was unwinding.

In… pic.twitter.com/tfdtEf4nU1

— David Puell (@dpuellARK) August 9, 2024The Spent Output Profit Ratio (SOPR) and Bitcoin’s Fear & Greed Index have reset, with the latter entering “Extreme Fear” territory for the first time since November 2022. This period of heightened fear and uncertainty often precedes strong recoveries as long-term holders, whose numbers have been increasing since April, continue to build a solid base.

The volatile nature of Bitcoin has become even more critical because of the changing financial scenario at a global scale. The Bank of Japan’s hawkish stance led to the yen’s sharp increase, which caused concerns for a yen carry trade, a nearly ten-year-old strategy, and it may be happening again.

Together with the U.S. employment report for July, the application of the Sahm Rule signaled the economy would be hit with a probable recession as the unemployment rate rose, which in turn complicated the economic future, by and large. Alongside these latest nightmares, the robustness of Bitcoin in the long run is put to the test, but according to history, those investors who are patient will be better off.

Related Reading | XRP Set for Massive 700% Surge by 2025, Analyst Predicts