![]()

contributor

Share this article

- Bitcoin’s limited supply creates the ideal conditions for a $130K target next year.

- Coinciding with key macro trends, anticipated volatility will determine how these factors unfold.

December began shrouded in skepticism, with many forecasting a major retrace following November’s historic sector growth. However, as Bitcoin [BTC] breaks the six-figure barrier, the narrative is beginning to shift.

Contrary to the optimism, the real psychological test is just starting. Having moved past the high-FUD zone, Bitcoin is poised for intense FOMO-driven inflows.

Yet, true volatility looms in Q1 next year, as macroeconomic shifts and a new administration challenge the rally’s resilience.

If Bitcoin maintains its ground, the bullish momentum could carry into 2025. However, given crypto’s history of defying mainstream expectations, it may be too early to anticipate a meteoric run toward price discovery.

A pragmatic look at Bitcoin’s past and present

Bitcoin has seen a daily increase of over 6%, which has pushed its price to a new all-time high of $103,900. This increase is attributed to strong buying momentum in both the spot and the perpetual markets.

Or a lack of selling pressure, suggesting that investors continue to ‘HODL,’ expecting an even greater boom cycle.

Initially, this momentum was built on ‘anticipation’ that lasted exactly 30 days, fueled by the Trump-pump, which pushed Bitcoin through this psychological barrier.

Now, Bitcoin’s greatest strength lies in its limited supply. With a capped supply and substantial interest from large investors, its potential seems limitless. However, the journey to realizing that potential won’t be a smooth one.

Source : IntoTheBlock

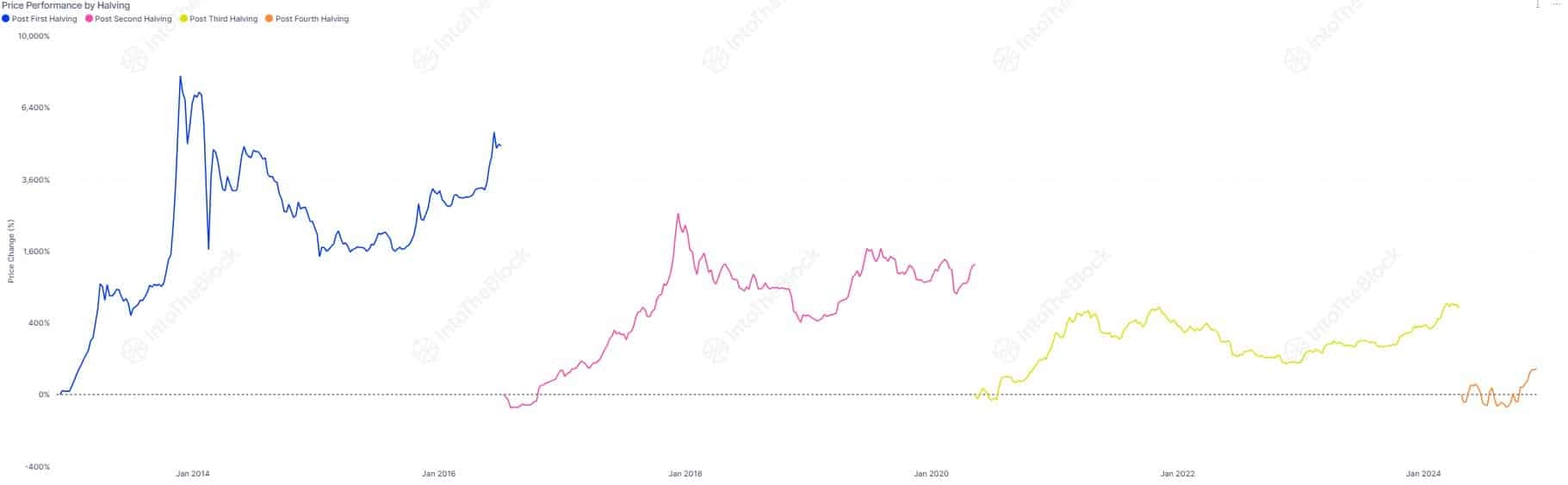

The chart above illustrates the returns following each Bitcoin halving cycle, revealing a clear trend of diminishing returns over time.

As each cycle progresses, it requires more capital to generate the same level of market movement.

For example, after the 2012 Bitcoin halving, the price surged by an astounding 7,900% in 2013. Similarly, following the 2020 halving, Bitcoin’s price rose by 594% in 2021.

While this is still a substantial return, it is significantly lower than the increases seen in the previous two cycles, suggesting that the market may have matured.

Consequently, it now takes more capital to push Bitcoin’s price up by the same percentage.

As a result, while some in the crypto community are predicting Bitcoin could reach a million dollars per coin, a more realistic expectation would be a 100%-200% return from the price post-halving.

This would place Bitcoin’s peak in the next cycle between $130,000 and $190,000.

A pragmatic look at BTC’s future

Certainly, a mix of micro trends is driving Bitcoin towards its next peak, likely around $130K. This upward movement is fueled by FOMO-driven buying pressure, growing institutional adoption, and the typical post-halving surge.

However, broader macro trends should not be overlooked. High volatility is expected to grip the market once the new government takes office next year.

There is considerable hope that President-elect Trump will implement several pro-crypto initiatives, including the establishment of a national strategic Bitcoin reserve, the elimination of taxes on crypto transactions, and the expansion of the crypto public equity markets through more IPOs.

Ultimately, the success of these initiatives will depend on their execution, which will play a pivotal role in shaping Bitcoin’s long-term prospects.

Read Bitcoin’s [BTC] Price Prediction 2024-25

New regulatory frameworks are likely to coincide with the post-halving surge next year, potentially creating a direct correlation between the two.

Therefore, a $130K target is achievable if the correlation remains complementary rather than conflicted.