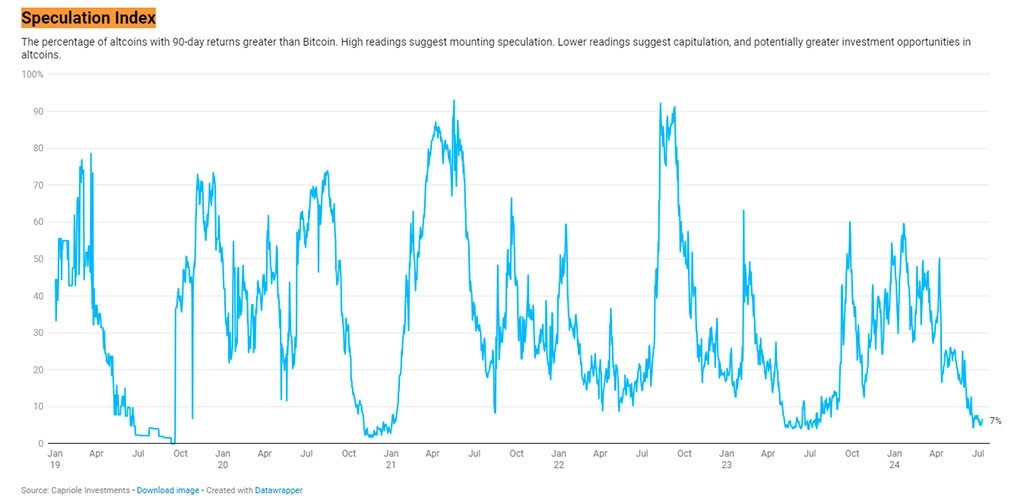

In January 2024, the crypto speculation index surged to nearly 60%, signaling intense altcoin speculation. However, it has since dropped below 10%, indicating a potential return to Bitcoin dominance.

Bull markets are known for their periods of exuberance, but these periods can’t last forever. The crypto market is no stranger to the cycle of ups and downs, and recent data suggests a potential turning point for Bitcoin (BTC).

Capriole Investments’ crypto speculation index, a measure of speculative activity in the altcoin market, has shown a dramatic decline. The index tracks the percentage of alternative cryptocurrencies with 90-day returns exceeding Bitcoin’s performance.

Photo: Capriole Investments

In January 2024, the index soared to nearly 60%, indicating a period of intense altcoin speculation. However, the frenzy has subsided significantly, with the index currently hovering below 10%. This cooldown suggests a potential return to dominance for Bitcoin, the leading cryptocurrency.

Why Altcoin Outperformance Matters

The vast altcoin landscape, featuring over 14,800 tokens according to CoinGecko, often serves as a breeding ground for speculation. Many altcoins lack established use cases and have limited trading volume. Google Trends data heavily influences retail investors’ interest in these altcoins.

When altcoins outperform Bitcoin significantly, analysts often view it as a sign of excessive speculation, potentially indicating a bubble ready to burst.

Corrections, even when speculative assets lose value, can benefit the overall crypto market. These “washouts” help realign asset prices with their underlying fundamentals and dampen excessive speculation, creating a more sustainable foundation for long-term growth.

Looking back, a similar pattern has emerged in previous market cycles. Since 2019, significant Bitcoin rallies have coincided with periods where the speculation index fell below 10%. This trend was observed in the first half of 2019, late 2020, and the second half of 2023.

Bitcoin’s Rise from Speculative Decline

As of July 11, 2024, Bitcoin is trading at $58,864, hovering slightly below its 24-hour high of $59,350 and surged 1% from yesterday. Trading volume has dipped by 5.9% as investors await critical inflation data. Notably, buying activity in derivatives markets remains subdued, with total Bitcoin futures holding steady at $26.59 billion.

Photo: CoinMarketCap

The decline in the crypto speculation index suggests a potential return to dominance for Bitcoin. With less speculative fervor in the altcoin market, Bitcoin could be poised for a renewed rally as investors seek stability and established value. However, key economic data and overall market sentiment will continue to influence Bitcoin’s price trajectory in the coming weeks.

Bitcoin News, Cryptocurrency News, News