Last week, markets took a breather from headline-driven volatility, while institutional bitcoin accumulation continued. Meanwhile, tokenized equities made their debut, and a broader reckoning is underway as investors question the Fat Protocol thesis.

This editorial is from last weeks edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second its finished.

The Fat Protocol Thesis Is CrackingRevenue Is the New Narrative

We start with macro. For more than a month, macro headlines controlled every market move, until last week. Thursdays better-than-expected U.S. non-farm-payrolls report crushed hopes of a July Fed rate cut, and pushed consensus expectations out to the September meeting.

In longer term macro changes, there were signs last week of the waning impact of monetary policy, and the rise of fiscal policy fiscal dominance as it is called.

The European Central Bank signaled its intention to meddle in capital allocation, saying, there is an urgent need to channel retail savings into capital markets to develop those markets and finance EU priorities.

Michael Green, best known for his groundbreaking work on passive investing, pointed out that:

If Europe moves towards 401K-style default passive/target date fund model, i.e. shifting a sizable fraction towards European countries, it will permanently impact American Exceptionalism.

Next up is Bitcoin. Bitcoin has been consolidating close below the all-time high the whole week. Institutions and corporate treasuries keep adding to their stacks, yet an informal Crypto Twitter poll suggests many natives remain under-allocated after missing the run toward $100k. It seems that natives are largely waiting for Bitcoin dominance to top, allowing a true alt season to begin.

One potential catalyst for an alt season is the approval of U.S. spot altcoin ETFs. James Seyffart and Eric Balchunas expect a wave of new ETFs in this second half of 2025. As Ive stated here, I dont think an alt season will happen until Bitcoin runs up a bit more.

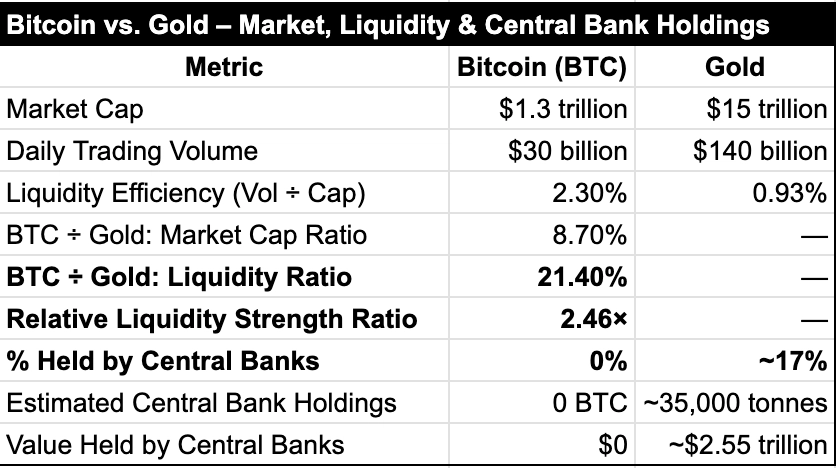

Now seems an appropriate moment for some Bitcoin hopium. Here is a chat that shows market, liquidity and Central Bank holdings of Bitcoin and Gold, giving some indication into Bitcoins opportunity for growth.

In other news, last week equities made their way to the blockchain. Solana and Robinhood unveiled tokenized stocks. The long-term vision of 24-hour trading, DeFi composability, and global access is compelling, yet this first implementation falls short for practically every conceivable user. Check out this post for a good explanation.

Nevertheless, settlement ledgers housed at the DTCC, Euroclear, or JASDEC will come on-chain in the coming years. Once equities become true on-chain primitives, dividends can be airdropped automatically, stocks can serve as defi collateral, and corporate actions can run on self-executing contracts. Adoption will feel glacial until, suddenly, it is the default.

Speaking of changes happening slowly, one of the biggest narrative shifts taking place right now is about the belief that the fat protocol thesis is wrong. Joel Monegros 2016 Fat Protocol post argued that base-layer protocols, not applications, will capture most of the value in crypto. In Web2, applications from Google and Facebook overwhelmingly accrued that value, while ISPs retained a sliver, and technology like HTML and TCP/IP got nothing.

This cycle has begun to challenge that logic. Many Layer 1 and Layer 2 tokens have performed badly despite impressive technology, because spinning up a chain has become so easy. Robinhoods Layer 2 announcement last week underscores the ease of proliferation. Bold captured that ease in a great comic.

At the same time, a revenue-centric narrative has taken hold. A number of crypto Investors finally want to see tangible cash flows accruing to tokens. My Token Narratives co-host Graham Stone joked that in crypto, it feels revolutionary merely to ask how much money a project makes and whether that money reaches token holders.