The TPG bungle began at 9.20am on Wednesday, when Sydney technology firm Infomedia released an ASX statement that private equity giant TPG Capital was buying the company. The ASX incorrectly linked TPG Telecoms ticker code, TPG, to the announcement, introducing false, price-sensitive information into the market under the wrong company.

Its a move that the ASX says was a case of inadvertent human error, but it could have lingering implications for TPG Telecom investors and for trust in the ASXs processes, which was already at a low ebb.

Six minutes after the announcement, TPG Telecom executives rang Infomedia, asking its executives to urgently engage with the ASX and remove the TPG cross-reference from the announcement. Infomedia then alerted the ASX and advised TPG Telecom it was an ASX error.

TPG Telecom CEO I�aki Berroeta. Credit: Louie Douvis

At 9.45am, TPG Telecom executives spoke with the ASX, which acknowledged the error and said it would correct it. TPG offered to issue a correction, but ASX executives said they would fix it themselves.

They didnt. When the market opened at 10am, shares in TPG Telecom immediately crashed, falling 5.09 per cent to a two-month low. Some $400 million was wiped from the telcos valuation.

The ASX placed TPG Telecom into a trading halt at 10.15am, while the erroneous announcement remained visible for another hour. A formal correction wasnt issued until 11.31am, over two hours after the initial error.

It was at 12.27pm that the ASX lifted the pause, and TPG Telecom started trading again. Despite the ASX ultimately cancelling the trades that were made before the pause, TPG Telecoms shares finished the day 5.1 per cent lower.

ASX chief executive Helen Lofthouse rang TPG Telecom CEO Inaki Berroeta on Wednesday evening to apologise, in a call described as cordial. ASX group executive markets and listings Darren Yip also apologised for the series of events in a statement earlier in the day.

He said the ASX moved quickly to address the issue an assertion contested by TPG Telecom and that shares in the company traded for about 15 minutes after the market opened before trading was paused.

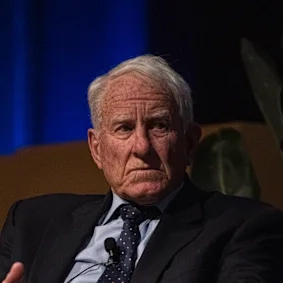

Robert Millner. Credit: SMH

This issue arose from an inadvertent human error and I recognise that it has caused disruption for TPG Telecom and its investors. Upon discovery of the error, it was escalated to me and I will be apologising directly to the team at TPG Telecom, he said.

An ASX spokesman said on Thursday: We have been in contact with TPG Telecom including with their CEO to apologise for the mistake. Weve also said we were open to take more questions from TPG Telecom and to give them further detail around the event. We were also in contact with them today.

The latest mistake is another blot on the ASX, which is already facing a probe by ASIC into other governance and operational failings, including a lengthy outage in December 2024.

The costs associated with the ASIC probe have started to balloon, with the company now expecting to absorb an extra $25 million to $35 million in costs.

The slip-up could not have come at a worse time for TPG Telecom, which had been spruiking a $3 billion capital return to investors on Tuesday, and leading a renewed charge against long-time rivals Telstra and Optus.

Robert Millner is the chairman of Soul Patts, which is one of TPGs largest investors. He called the stuff-up ridiculous.

There has been a continuing saga within the ASX. These things shouldnt happen, particularly with the technology weve got, he told The Australian Financial Reivew. Strewth.

Additional reporting Clancy Yeates.