- AAVE price lost nearly 12% this week, declining from $336 to about $256 as markets weakened.

- Volume increased 22% to $549.21 million, showing more active investor participation.

- Aave V3 upgrades boosted efficiency, while buybacks of 68,000+ tokens support long-term value.

AAVE, the Aave lending protocols governance token, has fallen close to 12% within the last seven days as sustained bearish pressure persists across the broader crypto space.

Following a short rally to a recent high of $336, AAVE price was not able to hold the rally and has since retraced quite sharply. The token is currently at $256.94, having declined 5% in the last 24 hours.

AAVE 7-Day Price Chart | Source CoinMarketcap

AAVE 7-Day Price Chart | Source CoinMarketcap Even with the AAVE price decrease, the volume of trading increased 22% to $549.21 million as investor activity picked up amid market volatility. AAVEs present market capitalization is at around $3.9 billion.

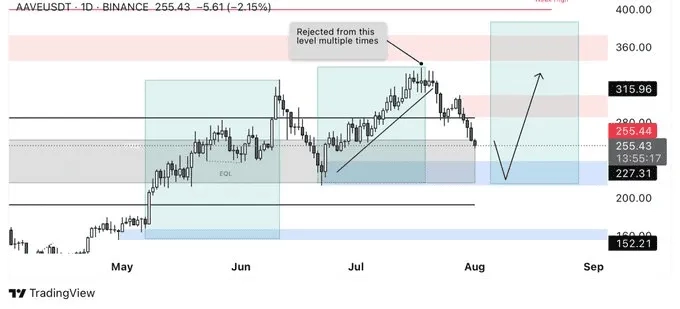

As per crypto analyst Bullish Banter, AAVE was rejected once more from a long-term resistance area. The tokens price is currently fluctuating in the area of $255260, with the next substantial support area pegged at $227.

Source: X

Source: X A bounce from that level could potentially set the stage for a move toward the $315 range, depending on broader market conditions.

Also Read: Aave Eyes $316 High: Key Resistance Levels to Break for Surge

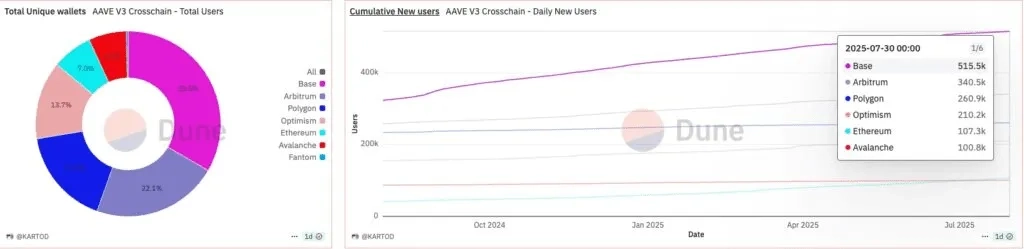

Though short-term performance is weak, Aave remains a baseline infrastructure for decentralized finance. The protocol now supports more than $55.7 billion in total value locked (TVL) and 1.1 million cross-chain users on 17 chains, emphasizing its solid multi-chain presence.

Source: dune.com/KARTOD

Source: dune.com/KARTOD Aave V3 rollout increased protocol effectiveness and protection considerably. Features like Isolation Mode, E-Mode, and Siloed Borrowing enable more flexible and secure deployment of assets. These improvements have enhanced capital usage as well as user protection, attracted additional liquidity to the platform.

Aaves ability to generate revenue is likewise a primary strength. To the present moment, the protocol has pulled in over $173 million, primarily through Ethereum activity, with significant contributions now being made through Layer-2 solutions like Polygon and Arbitrum.

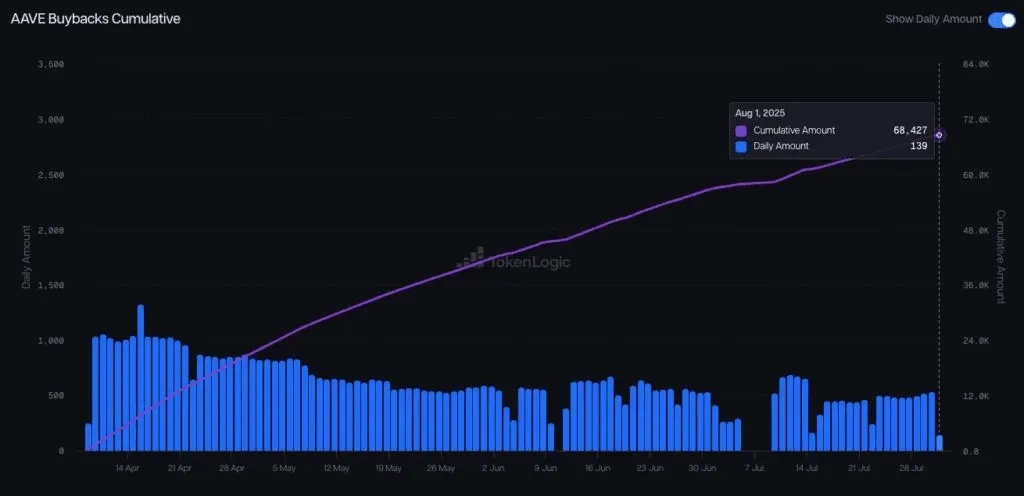

An ongoing buyback of more than 68,000 AAVE tokens is likewise in place for long-term token appreciation as well as solid tokenomics.

Source: tokenlogic.xyz

Source: tokenlogic.xyz In spite of near-term pressure on prices, AAVEs solid fundamentals and pipeline of innovations imply good long-term growth prospects.

Also Read: AAVE Price Action Builds Toward $400 Bullish Target